Acting U.S. Attorney To Investigate Justice Department Dismissals

The Hartford Courant by EDMUND H. MAHONY - September 30, 2008

Acting U.S. Attorney Nora R. Dannehy became the third, senior federal prosecutor from Connecticut to land at the center of a high-profile, Washington political case when she was appointed Monday to look for criminal violations in the dismissal by the Justice Department of nine prosecutors in 2006. Dannehy, a career prosecutor known for winning convictions against Gov. John G. Rowland and state Treasurer Paul Silvester, was named by Attorney General Michael B. Mukasey to investigate "unanswered" questions about the Bush administration's dismissal of the U.S. attorneys, which was widely assailed as being politically motivated. Dannehy's appointment followed the release Monday of a report on an 18-month-long, internal Justice Department investigation that concluded top department officials "abdicated their responsibility" by failing to supervise subordinates who carried out the nine dismissals. What's more, the inquiry found "significant evidence" that partisan political factors played a role in some of the dismissals. The report, by the Justice Department offices of Inspector General and Professional Responsibility, said that former U.S. Attorney General Alberto Gonzales "bears primary responsibility" for what amounted to a series of botched removals. But it said that gaps remain in the investigation because of the refusal by key witnesses — among them former White House officials Karl Rove and Harriet Miers and U.S. Sen. Pete Domenici, R-N.M. — to submit to interviews. The authors of the report recommended that Mukasey name a special counsel to "ultimately determine whether the evidence demonstrates that any criminal offense was committed with regard to the removal of any U.S. Attorney, or with regard to the testimony of any witness related to the U.S. Attorney removals."

"Alberto Gonzalez is in trouble," said Connecticut defense attorney Hugh Keefe, who traded blows with Dannehy while representing Rowland co-chief of staff Peter N. Ellef Sr. in the corruption prosecution that led to the imprisonment of both Ellef and Rowland. "She is analytical and she is thorough, and if she suspects wrongdoing she will not let it go." Dannehy's grueling work schedule, her success at supervising long and complex investigations and her reputation for unstinting pursuit of what at times can seem to be tenuous evidence of criminal conduct are traits regularly volunteered by colleagues and attorneys on the defense side of her cases. But she just as frequently is applauded for forthrightness. Members of the relatively small group of defense attorneys who have done battle with her in high-profile Connecticut criminal trials have said that she means what she says and does what she promises — behavior that often falls by the wayside in pricey legal fights.

An Exodus Of Talent

Dannehy's appointment marks the most recent in what has become a series of high-level migrations to Washington from the U.S. attorney's office in New Haven. In April 2007, Gonzalez named former Connecticut U.S. Attorney Kevin O'Connor to be his chief of staff, just as Gonzales' job was beginning to unravel over political fallout from the dismissal of the U.S. attorneys. In November 2007, President Bush nominated O'Connor to be associate attorney general, the No. 3 position at the Justice Department. The U.S. Senate confirmed the nomination.

In January, Deputy U.S. Attorney John Durham — a veteran mob-buster, public corruption prosecutor and Dannehy mentor — was appointed to lead the Justice Department's investigation of the destruction of CIA videotapes documenting the interrogation of al-Qaida terror suspects. Durham's temporary transfer to Washington, which is ongoing, followed his long-term assignment to Boston, where he was assigned to investigate law enforcement corruption. One of Durham's Boston targets, former FBI Agent John Connolly, is on trial for murder in Miami, where he is accused of leaking information that compelled gangsters to kill a potential witness. Dannehy's assignment to Washington could give her more time with her husband, Leonard Boyle, another former Connecticut federal prosecutor who has been commuting between Connecticut and his job as director of the FBI Terrorist Screening Center's 350 employees.

The 5-year-old center operates a watch list of suspected terrorists. At times Monday, news of Dannehy's appointment seemed to submerge amid talk in legal circles of the continuing — if mostly temporary — exodus of federal prosecutorial talent. "It's really quite amazing," said defense attorney Hubert Santos, who represents Hartford Mayor Eddie Perez, now embroiled in a corruption investigation. "Durham and Dannehy have the two major criminal investigations in the country." Said Carl Tobias, who is on the faculty of the University of Richmond School of Law in Virginia, "It is somewhat curious that three attorneys for these critical positions all come from the same Connecticut U.S. attorney's office. She seems like a highly qualified career prosecutor who will carefully lead this investigation." Connecticut Attorney General Richard Blumenthal, whose office has at times bumped uncomfortably against Dannehy in political corruption cases, called her "a superb choice to conduct this much-needed, indeed, long-overdue investigation."

Formidable Opponent

Characteristically, Dannehy, 47, would not discuss her appointment and instructed her office not to do so. She has tried mightily throughout her career to avoid the limelight, even as that task has become more difficult with her involvement in high-profile political corruption cases. She became acting U.S. attorney following O'Connor's appointment as associate attorney general. Dannehy's acting appointment is expected to remain in force until the White House and Congress agree on a replacement for O'Connor.

A Justice Department spokesman in New Haven said that Dannehy is expected to begin the Washington investigation almost immediatelyand will divide her time between responsibilities in Washington and New Haven. Dannehy, an almost compulsive runner, is a formidable legal competitor. In one of her more memorable prosecutions, she emerged victorious after a three-year legal fight with top members of the Boston defense bar in the prosecution of a financier charged with bribery in the Silvester case. The Boston lawyers tried repeatedly to have her disqualified. She threatened to indict one of them for obstruction of justice. All but three of the state's federal judges removed themselves from the case over potential conflicts. Another withdrew in frustration. In the end, financier Frederick McCarthy was fined $40,000 and imprisoned. His company, Triumph Capital, was fined $4 million and driven out of business.

MLK said: "Injustice Anywhere is a Threat to Justice Everywhere"

End Corruption in the Courts!

Court employee, judge or citizen - Report Corruption in any Court Today !! As of June 15, 2016, we've received over 142,500 tips...KEEP THEM COMING !! Email: CorruptCourts@gmail.com

Most Read Stories

- Tembeckjian's Corrupt Judicial 'Ethics' Commission Out of Control

- As NY Judges' Pay Fiasco Grows, Judicial 'Ethics' Chief Enjoys Public-Paid Perks

- New York Judges Disgraced Again

- Wall Street Journal: When our Trusted Officials Lie

- Massive Attorney Conflict in Madoff Scam

- FBI Probes Threats on Federal Witnesses in New York Ethics Scandal

- Federal Judge: "But you destroyed the faith of the people in their government."

- Attorney Gives New Meaning to Oral Argument

- Wannabe Judge Attorney Writes About Ethical Dilemmas SHE Failed to Report

- 3 Judges Covered Crony's 9/11 Donation Fraud

- Former NY State Chief Court Clerk Sues Judges in Federal Court

- Concealing the Truth at the Attorney Ethics Committee

- NY Ethics Scandal Tied to International Espionage Scheme

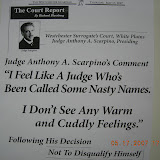

- Westchester Surrogate's Court's Dastardly Deeds

Tuesday, September 30, 2008

Acting U.S. Attorney To Investigate Justice Department Dismissals

Monday, September 29, 2008

Outrage: Elderly Tax Lawyer Told He Can't Write Off Hookers

A state judge has ruled that a 77-year-old Bay Ridge tax lawyer must pay back taxes after wrongfully deducting more than $300,000 for prostitutes, porn, sex toys and erotic massages. After the verdict, the defendant William Halby told the Post, "I live a solitary life. I have no social life. I needed that release." So he dutifully documented each liaison in a notebook titled "Tax Journal," in case he ever got audited. Turns out that in 2002 alone, Halby deducted $111,364 for "therapeutic sex" and massages "to relieve osteoarthritis and enhance erectile function through frequent orgasm." He argued that the write-offs were necessary medical expenses. But because "significant portions" of his sex therapy was, you know, illegal, they can't be written off. The state auditor also argued that "in addition to being illegal in New York State, these expenses are not substantiated with receipts."

KINKY BID TO BE TAX XXX-EMPT

The New York Post by BRENDAN SCOTT and KEVIN FASICK - September 19, 2008

This was not the "happy ending" William Halby was looking for. The 77-year-old Brooklyn lawyer owes tens of thousands of dollars in back taxes for wrongly deducting more than $300,000 in prostitutes, porn, sex toys and erotic massages, a state tax judge ruled yesterday. The ruling came despite the meticulous efforts of Halby - a tax lawyer - to prove the deductions were reasonable medical expenses in his effort to fight depression and erectile dysfunction brought on by age. "I was depressed," Halby, who's divorced, semi-retired and living alone in a Bay Ridge apartment, told The Post yesterday. "I live a solitary life. I have no social life. I needed that release." Halby said he found his "sex surrogates" - preferably brunettes - through ads in The Village Voice and sometimes visited them several times a week. "Over the years, I've been with dozens of girls for full-body massage with . . . happy ending," he said. All told, Halby spent about $322,000 to satisfy his desires, according to court papers.

In 2002 alone, Halby deducted $111,364 for "therapeutic sex" and massages "to relieve osteoarthritis and enhance erectile function through frequent orgasm." He claimed another $2,173 on porn "to enhance sexual performance in lieu of taking Viagra." In 2003, his $101,930 in deductions included $162 for "sexual performance aids" such as lubes, condoms and nipple clamps, the court papers said. But the Department of Taxation and Finance roundly rejected the deductions, leaving the septuagenarian sex addict with a $24,271 state tax bill. "It must be noted that portions of [Halby's] 'sex therapy' were, in fact, sex for a fee, in violation of penal law," Administrative Law Judge Brian Friedman wrote. Halby, who faces similar action by the IRS, said he will appeal.

A former counsel for the Equitable Life Insurance Society of the United States, Halby represented himself through the proceedings. He meticulously recorded each liaison in a notebook titled "Tax Journal," including the cost and practitioners' first names. When auditors challenged the expenses, he produced books and articles demonstrating the health benefits of sex, including a 2001 New York Post article about the use of sex workers in Danish nursing homes. A state auditor dryly rejected the arguments. "Illegal treatments cannot be included in expenses," the auditor said. "In addition to being illegal in New York state, these expenses are not substantiated with receipts." Halby is "of counsel" with the Larchmont law firm McMillan, Constabile, Maker & Perone. Halby infrequently assists the firm with tax issues. A firm partner, Stewart McMillan, had not heard of Halby's tax troubles. "He seems like a nice man," McMillan said. "He's thought of as a good tax lawyer." brendan.scott@nypost.com

KINKY BID TO BE TAX XXX-EMPT

The New York Post by BRENDAN SCOTT and KEVIN FASICK - September 19, 2008

This was not the "happy ending" William Halby was looking for. The 77-year-old Brooklyn lawyer owes tens of thousands of dollars in back taxes for wrongly deducting more than $300,000 in prostitutes, porn, sex toys and erotic massages, a state tax judge ruled yesterday. The ruling came despite the meticulous efforts of Halby - a tax lawyer - to prove the deductions were reasonable medical expenses in his effort to fight depression and erectile dysfunction brought on by age. "I was depressed," Halby, who's divorced, semi-retired and living alone in a Bay Ridge apartment, told The Post yesterday. "I live a solitary life. I have no social life. I needed that release." Halby said he found his "sex surrogates" - preferably brunettes - through ads in The Village Voice and sometimes visited them several times a week. "Over the years, I've been with dozens of girls for full-body massage with . . . happy ending," he said. All told, Halby spent about $322,000 to satisfy his desires, according to court papers.

In 2002 alone, Halby deducted $111,364 for "therapeutic sex" and massages "to relieve osteoarthritis and enhance erectile function through frequent orgasm." He claimed another $2,173 on porn "to enhance sexual performance in lieu of taking Viagra." In 2003, his $101,930 in deductions included $162 for "sexual performance aids" such as lubes, condoms and nipple clamps, the court papers said. But the Department of Taxation and Finance roundly rejected the deductions, leaving the septuagenarian sex addict with a $24,271 state tax bill. "It must be noted that portions of [Halby's] 'sex therapy' were, in fact, sex for a fee, in violation of penal law," Administrative Law Judge Brian Friedman wrote. Halby, who faces similar action by the IRS, said he will appeal.

A former counsel for the Equitable Life Insurance Society of the United States, Halby represented himself through the proceedings. He meticulously recorded each liaison in a notebook titled "Tax Journal," including the cost and practitioners' first names. When auditors challenged the expenses, he produced books and articles demonstrating the health benefits of sex, including a 2001 New York Post article about the use of sex workers in Danish nursing homes. A state auditor dryly rejected the arguments. "Illegal treatments cannot be included in expenses," the auditor said. "In addition to being illegal in New York state, these expenses are not substantiated with receipts." Halby is "of counsel" with the Larchmont law firm McMillan, Constabile, Maker & Perone. Halby infrequently assists the firm with tax issues. A firm partner, Stewart McMillan, had not heard of Halby's tax troubles. "He seems like a nice man," McMillan said. "He's thought of as a good tax lawyer." brendan.scott@nypost.com

Sunday, September 28, 2008

Gov. Paterson Taking Charge: Vetos Court Power Scam

Paterson Rules Out Interlocutory Appeals In Jury Selection

The New York Law Journal by Joel Stashenko - September 29, 2008

ALBANY - A bill that would have established an interlocutory appeals process for disputed juror selections in civil trials was vetoed Friday by Governor David A. Paterson. The legislation (A11715/S8661) would have designated administrative judges in each judicial district to hear disputes over jury selection as they arose and created a right for parties to bring Article 78 proceedings if decisions by the administrative judges reflect a "deliberate failure" to adhere to selection procedures. The measure also called on the administrative board of the state courts, comprised of Chief Judge Judith S. Kaye and the four presiding Appellate Division justices, to establish new standardized selection procedures for Supreme and county courts throughout New York. The legislation has been pushed for years by the state Trial Lawyers Association, which contends that some judges and judicial hearing officers are flouting established procedures for choosing jurors. In opposition were the Fund for Modern Courts, the New York State Bar Association, New York City's Corporation Counsel and the state League of Women Voters. The New York City Bar Association's Committee on State Courts of Superior Jurisdiction also urged a veto of the bill. Opponents argued that the measure would have delayed the jury selection process in many cases, stretching already thin court resources, and undermined Chief Judge Kaye's campaign to make courts more juror-friendly.

In a veto message, Mr. Paterson explained that he had heard no "urgent or compelling justification" for signing a bill that makes several significant changes in court procedures. "The problem with this bill is that the proposed mechanisms contravene well-settled legal principles governing review of trial court determinations and would create logistical burdens that could unnecessarily delay trials and seriously inconvenience citizens performing their civic duties by appearing as jurors to hear civil cases," the veto message said. Mr. Paterson also noted that parties aggrieved by an error in the jury selection process can still seek to file a conventional appeal of an adverse judgment.

The bill had passed in the Assembly by a vote of 137-1 and in the Senate by 62-0. It was sponsored by the Judiciary Committee chairs in both chambers of the Legislature, Senator John A. DeFrancisco, R-Syracuse, and Assemblywoman Helene Weinstein, D-Brooklyn. Neither returned a call seeking comment Friday. The president of the Trial Lawyers Association, Nicholas Papain, said he was disappointed with the veto and would renew efforts to pass the measure during the next legislative session beginning in January. "We feel strongly that this bill was necessary to ensure that jury selection is conducted more fairly and that there are remedies when those in charge fail to follow the rules," Mr. Papain, a partner at Sullivan, Papain Block McGrath & Cannavo, said in an interview Friday. "A fair jury selection process is a cornerstone of our civil justice system."

The legislation was something of a compromise from an alternative measure (A8964B) that would have adopted the new procedures in a statute and not given any discretion to the administrative board (NYLJ, June 20). The state's chief administrative judge, Ann Pfau, lobbied against that bill, arguing that juror selection procedures were a matter for the court system to set and enforce. Court administrators say they can accomplish through court rule some of the reforms sought by the trial lawyers. Among other things, the group has complained that jury selection procedures can vary from court to court, sometimes from judge to judge, and should be standardized statewide in fairness to litigants and their attorneys. "The Trial Lawyers have brought to our attention some concerns that they have and we take their concerns very seriously," Judge Pfau said. "We look forward to working with them productively to address those concerns."

Mr. Papain said he would welcome changes by the administrative board to standardize jury selection procedures, but would not abandon the legislative approach. Legislation would be needed to create the appeals process for parties claiming that jury selection rules were being deliberately violated. "We feel very strongly that we must continue to pursue this avenue, that being legislation," Mr. Papain said. Lawpac, the Trial Lawyers Association's political action committee, gave Mr. Paterson's campaign committee a total of $54,900 in two donations on May 29. The donations were for $36,800 and $18,100.

Delays Feared

Appeals "have to [cause] more delay," said Victor A. Kovner, the chairman of the Committee for Modern Courts. "Unfortunately, there will be some lawyers who will try to take advantage of the system and play games with the process. We just can't have the jurors subjected to that." Modern Courts favors adoption of a uniform method of selecting civil juries throughout the state, Mr. Kovner said in an interview. "I think all of this can be accomplished by a court rule without delaying and stopping the jury selection process," he said.

New York City Corporation Counsel Michael A. Cardozo was also a critic of first A8964B and later of the bill that Mr. Paterson vetoed (NYLJ, Sept. 5). "I am very pleased that the governor has recognized that there is no need for this bill and that it could potentially cause substantial mischief in the selection of juries," Mr. Cardozo said in an interview. Typically, jury selection begins in between 400 and 500 civil cases a year in which Mr. Cardozo's attorneys defend New York City. The corporation counsel's office tried 122 cases to verdict last year.

"If everything was slowed down, we were going to have to find more lawyers to try those cases," Mr. Cardozo said. "Particularly at this time of budget crunch, I don't think we could have done it. It could have paralyzed the system." Mr. Papain said his 4,000-member group has received complaints about several aspects of unfair jury selection procedures, including instances where judges or judicial hearing officers have ignored rules calling for lawyers for the plaintiff and the defendant to alternate their challenges striking jurors. The situation is unfair where a lawyer is made to use challenges on jurors that the other side would have removed if the attorneys had alternated, Mr. Papain said. Other times, he said, lawyers have not been allowed to voir dire jurors on their attitudes toward damages in bifurcated trials, even though those same jurors would consider the question of compensation if they found the defendant liable for damages. Joel.Stashenko@incisivemedia.com

The New York Law Journal by Joel Stashenko - September 29, 2008

ALBANY - A bill that would have established an interlocutory appeals process for disputed juror selections in civil trials was vetoed Friday by Governor David A. Paterson. The legislation (A11715/S8661) would have designated administrative judges in each judicial district to hear disputes over jury selection as they arose and created a right for parties to bring Article 78 proceedings if decisions by the administrative judges reflect a "deliberate failure" to adhere to selection procedures. The measure also called on the administrative board of the state courts, comprised of Chief Judge Judith S. Kaye and the four presiding Appellate Division justices, to establish new standardized selection procedures for Supreme and county courts throughout New York. The legislation has been pushed for years by the state Trial Lawyers Association, which contends that some judges and judicial hearing officers are flouting established procedures for choosing jurors. In opposition were the Fund for Modern Courts, the New York State Bar Association, New York City's Corporation Counsel and the state League of Women Voters. The New York City Bar Association's Committee on State Courts of Superior Jurisdiction also urged a veto of the bill. Opponents argued that the measure would have delayed the jury selection process in many cases, stretching already thin court resources, and undermined Chief Judge Kaye's campaign to make courts more juror-friendly.

In a veto message, Mr. Paterson explained that he had heard no "urgent or compelling justification" for signing a bill that makes several significant changes in court procedures. "The problem with this bill is that the proposed mechanisms contravene well-settled legal principles governing review of trial court determinations and would create logistical burdens that could unnecessarily delay trials and seriously inconvenience citizens performing their civic duties by appearing as jurors to hear civil cases," the veto message said. Mr. Paterson also noted that parties aggrieved by an error in the jury selection process can still seek to file a conventional appeal of an adverse judgment.

The bill had passed in the Assembly by a vote of 137-1 and in the Senate by 62-0. It was sponsored by the Judiciary Committee chairs in both chambers of the Legislature, Senator John A. DeFrancisco, R-Syracuse, and Assemblywoman Helene Weinstein, D-Brooklyn. Neither returned a call seeking comment Friday. The president of the Trial Lawyers Association, Nicholas Papain, said he was disappointed with the veto and would renew efforts to pass the measure during the next legislative session beginning in January. "We feel strongly that this bill was necessary to ensure that jury selection is conducted more fairly and that there are remedies when those in charge fail to follow the rules," Mr. Papain, a partner at Sullivan, Papain Block McGrath & Cannavo, said in an interview Friday. "A fair jury selection process is a cornerstone of our civil justice system."

The legislation was something of a compromise from an alternative measure (A8964B) that would have adopted the new procedures in a statute and not given any discretion to the administrative board (NYLJ, June 20). The state's chief administrative judge, Ann Pfau, lobbied against that bill, arguing that juror selection procedures were a matter for the court system to set and enforce. Court administrators say they can accomplish through court rule some of the reforms sought by the trial lawyers. Among other things, the group has complained that jury selection procedures can vary from court to court, sometimes from judge to judge, and should be standardized statewide in fairness to litigants and their attorneys. "The Trial Lawyers have brought to our attention some concerns that they have and we take their concerns very seriously," Judge Pfau said. "We look forward to working with them productively to address those concerns."

Mr. Papain said he would welcome changes by the administrative board to standardize jury selection procedures, but would not abandon the legislative approach. Legislation would be needed to create the appeals process for parties claiming that jury selection rules were being deliberately violated. "We feel very strongly that we must continue to pursue this avenue, that being legislation," Mr. Papain said. Lawpac, the Trial Lawyers Association's political action committee, gave Mr. Paterson's campaign committee a total of $54,900 in two donations on May 29. The donations were for $36,800 and $18,100.

Delays Feared

Appeals "have to [cause] more delay," said Victor A. Kovner, the chairman of the Committee for Modern Courts. "Unfortunately, there will be some lawyers who will try to take advantage of the system and play games with the process. We just can't have the jurors subjected to that." Modern Courts favors adoption of a uniform method of selecting civil juries throughout the state, Mr. Kovner said in an interview. "I think all of this can be accomplished by a court rule without delaying and stopping the jury selection process," he said.

New York City Corporation Counsel Michael A. Cardozo was also a critic of first A8964B and later of the bill that Mr. Paterson vetoed (NYLJ, Sept. 5). "I am very pleased that the governor has recognized that there is no need for this bill and that it could potentially cause substantial mischief in the selection of juries," Mr. Cardozo said in an interview. Typically, jury selection begins in between 400 and 500 civil cases a year in which Mr. Cardozo's attorneys defend New York City. The corporation counsel's office tried 122 cases to verdict last year.

"If everything was slowed down, we were going to have to find more lawyers to try those cases," Mr. Cardozo said. "Particularly at this time of budget crunch, I don't think we could have done it. It could have paralyzed the system." Mr. Papain said his 4,000-member group has received complaints about several aspects of unfair jury selection procedures, including instances where judges or judicial hearing officers have ignored rules calling for lawyers for the plaintiff and the defendant to alternate their challenges striking jurors. The situation is unfair where a lawyer is made to use challenges on jurors that the other side would have removed if the attorneys had alternated, Mr. Papain said. Other times, he said, lawyers have not been allowed to voir dire jurors on their attitudes toward damages in bifurcated trials, even though those same jurors would consider the question of compensation if they found the defendant liable for damages. Joel.Stashenko@incisivemedia.com

Saturday, September 27, 2008

Judge Caught Driving Drunk in Drag Steers Way to Law Firm Gig

The National Law Journal by Sheri Qualters - September 25, 2008

BOSTON — Former U.S. District of Massachusetts federal bankruptcy judge Robert Somma, who resigned after a drunk driving arrest, is now senior counsel at Posternak Blankstein & Lund. Somma joined the bankruptcy department at Posternak, a Boston-based midsize law firm. Somma was a federal bankruptcy judge in Massachusetts from 2005 to 2008. Throughout his career, he has represented attorneys general of the United States in mass tort cases, including the Chapter 11 asbestos case of Manville Corp., as well as many New England real estate developers and public and private companies in various industries, including technology, manufacturing, retailing and financial services. "We are delighted that Bob has joined Posternak.

Bob's experience in private practice and on the bench is unparalleled and will add extraordinary depth to our growing bankruptcy practice," said Larry Athan, Posternak's managing partner. Somma tried to rescind his resignation, which he initially turned in on Feb. 15 to take effect on April 1. More than 200 Boston-area bankruptcy lawyers signed on to a letter supporting him that was sent to the 1st U.S. Circuit Court of Appeals. His resignation was effective on May 30. Somma was arrested on Feb. 6 in Manchester, N.H., while wearing women's evening wear, according to Associated Press reports. On Feb. 13, he pleaded no contest to a misdemeanor charge of allegedly driving while intoxicated in Manchester District Court in Manchester, N.H. He also paid $600 in fines and penalties and had his driver's license suspended for one year.

BOSTON — Former U.S. District of Massachusetts federal bankruptcy judge Robert Somma, who resigned after a drunk driving arrest, is now senior counsel at Posternak Blankstein & Lund. Somma joined the bankruptcy department at Posternak, a Boston-based midsize law firm. Somma was a federal bankruptcy judge in Massachusetts from 2005 to 2008. Throughout his career, he has represented attorneys general of the United States in mass tort cases, including the Chapter 11 asbestos case of Manville Corp., as well as many New England real estate developers and public and private companies in various industries, including technology, manufacturing, retailing and financial services. "We are delighted that Bob has joined Posternak.

Bob's experience in private practice and on the bench is unparalleled and will add extraordinary depth to our growing bankruptcy practice," said Larry Athan, Posternak's managing partner. Somma tried to rescind his resignation, which he initially turned in on Feb. 15 to take effect on April 1. More than 200 Boston-area bankruptcy lawyers signed on to a letter supporting him that was sent to the 1st U.S. Circuit Court of Appeals. His resignation was effective on May 30. Somma was arrested on Feb. 6 in Manchester, N.H., while wearing women's evening wear, according to Associated Press reports. On Feb. 13, he pleaded no contest to a misdemeanor charge of allegedly driving while intoxicated in Manchester District Court in Manchester, N.H. He also paid $600 in fines and penalties and had his driver's license suspended for one year.

Friday, September 26, 2008

More insight into underbelly of corruption

Check out this new website: www.rudyveritas.com

Thursday, September 25, 2008

Deskovic Calls for Jeanine Pirro Boycott

Freed Man Calls for Boycott of Ex-DA Jeanine Pirro's New TV Show

New York Lawyer - September 25, 2008

NEW YORK (AP) - An innocent man who blames Jeanine Pirro for his 16 years in prison is calling for a boycott of her new television show. Jeffrey Deskovic says the "Judge Jeanine Pirro" show on the CW Television Network "glorifies, promotes and compensates those who have participated in human and civil rights violations." He's calling for a boycott of the network, its affiliates and its advertisers. Laura Mandel, a publicist for the show's production company, would not comment. The 35-year-old Deskovic, who is suing Pirro, claims that when she was Westchester district attorney she refused his requests to run DNA tests after he was convicted of killing a teenage girl. Pirro has said she does not recall denying or even receiving such requests.

New York Lawyer - September 25, 2008

NEW YORK (AP) - An innocent man who blames Jeanine Pirro for his 16 years in prison is calling for a boycott of her new television show. Jeffrey Deskovic says the "Judge Jeanine Pirro" show on the CW Television Network "glorifies, promotes and compensates those who have participated in human and civil rights violations." He's calling for a boycott of the network, its affiliates and its advertisers. Laura Mandel, a publicist for the show's production company, would not comment. The 35-year-old Deskovic, who is suing Pirro, claims that when she was Westchester district attorney she refused his requests to run DNA tests after he was convicted of killing a teenage girl. Pirro has said she does not recall denying or even receiving such requests.

Gov. Paterson Seeks Reversal of Judges' Pay Order

Paterson Seeks Reversal of Order to Boost Judges' Pay

The New York Law Journal by Dan Wise - September 25, 2008

Governor David A. Paterson yesterday filed his brief in the Appellate Division, First Department, asking for the reversal of an order requiring that judges' salaries be boosted to reflect the rise in the cost of living since 1999. In June, Manhattan Supreme Court Justice Edward H. Lehner (See Profile) ruled that a raise is required because the legislative and executive branches had violated the separation of powers doctrine by linking a raise to unrelated issues, such as a raise for lawmakers or campaign finance reform (NYLJ, June 11). In Mr. Paterson's brief, his lawyer, Richard H. Dolan, attacks Justice Lehner's ruling as creating "a wholly new Constitutional doctrine of forbidden 'linkage'" that is "as unworkable as it is baseless and unwise." The Attorney General's Office, which is representing the Assembly and Senate, did not submit a separate brief but instead endorsed the arguments advanced for the executive branch by Mr. Dolan of Schlam Stone & Dolan. Thomas Bezanson of Chadbourne & Parke, who represented the four plaintiff judges in Larabee v. Governor, 11201/07, said in an interview that "abandonment of linkage is an incredibly simple step to take" to comply with the state Constitution and "do the right thing" and provide the first raise for the state's 1,300 judges in nearly a decade. The judges' brief defending Justice Lehner's opinion granting them summary judgment on their separation of powers claim is due Oct. 24. The appeal will be argued during the week of Nov. 17. The First Department had stayed Justice Lehner's order, which required enactment of a raise within 90 days, but ordered the two sides to submit their briefs on an expedited schedule.

The New York Law Journal by Dan Wise - September 25, 2008

Governor David A. Paterson yesterday filed his brief in the Appellate Division, First Department, asking for the reversal of an order requiring that judges' salaries be boosted to reflect the rise in the cost of living since 1999. In June, Manhattan Supreme Court Justice Edward H. Lehner (See Profile) ruled that a raise is required because the legislative and executive branches had violated the separation of powers doctrine by linking a raise to unrelated issues, such as a raise for lawmakers or campaign finance reform (NYLJ, June 11). In Mr. Paterson's brief, his lawyer, Richard H. Dolan, attacks Justice Lehner's ruling as creating "a wholly new Constitutional doctrine of forbidden 'linkage'" that is "as unworkable as it is baseless and unwise." The Attorney General's Office, which is representing the Assembly and Senate, did not submit a separate brief but instead endorsed the arguments advanced for the executive branch by Mr. Dolan of Schlam Stone & Dolan. Thomas Bezanson of Chadbourne & Parke, who represented the four plaintiff judges in Larabee v. Governor, 11201/07, said in an interview that "abandonment of linkage is an incredibly simple step to take" to comply with the state Constitution and "do the right thing" and provide the first raise for the state's 1,300 judges in nearly a decade. The judges' brief defending Justice Lehner's opinion granting them summary judgment on their separation of powers claim is due Oct. 24. The appeal will be argued during the week of Nov. 17. The First Department had stayed Justice Lehner's order, which required enactment of a raise within 90 days, but ordered the two sides to submit their briefs on an expedited schedule.

Wednesday, September 24, 2008

Attorney Reports Self to Disciplinary Committee

Ex-Sullivan Partner Resigns Bar Over $500,000 in False Billings

The New York Law Journal by Anthony Lin - September 24, 2008

A former Sullivan & Cromwell partner has resigned from the bar for billing his clients and firm more than $500,000 in fraudulent travel and entertainment expenses. Carlos J. Spinelli-Noseda, a banking and finance specialist who joined Sullivan & Cromwell straight out of Harvard Law School in 1994 and became a partner in 2003, was facing a disciplinary investigation over a pattern of improper billing dating from roughly July 1998 to February 2008. In a June 3 affidavit of resignation he submitted to the disciplinary committee of the First Department, Mr. Spinelli-Noseda admitted he could not successfully defend himself against charges of professional misconduct. Such resignations are frequently tendered when further proceedings are almost certain to lead to disbarment. "I acknowledge that my actions violated the New York Lawyer's Code of Professional Responsibility, notably DR 1-102(A)(4) inasmuch as my conduct constituted dishonesty, fraud, deceit and misrepresentation," he stated in the affidavit, "and DR 1-102(A)(7) inasmuch as my conduct adversely reflects on my fitness and integrity as a lawyer." The Appellate Division, First Department, yesterday accepted Mr. Spinelli-Noseda's resignation on the disciplinary committee's motion In the Matter of Carlos J. Spinelli-Noseda, M-2908.

Mr. Spinelli-Noseda stepped down from his position at Sullivan & Cromwell in March. In a statement the firm said: "Upon discovery, the matter was promptly referred to the appropriate authorities. The Firm fully cooperated with those authorities, contacted affected clients and made restitution." Mr. Spinelli-Noseda's lawyer, John B. Harris of Stillman, Friedman & Shechtman, said his client "deeply regrets" his conduct and had pledged to repay the firm. "In cooperation with his former law firm, he has fully identified all of his improperly submitted expenses and is working to make all appropriate restitution," said Mr. Harris. Mr. Spinelli-Noseda, who is in his late 30s, is the latest large firm partner to engage in expense fraud.

Earlier this year, Samuel A. Fishman, a former Latham & Watkins partner pleaded guilty to criminal fraud charges after submitting around $300,000 in fake expenses. In 2006, former Wilmer Cutler Pickering Hale and Dorr intellectual property partner William P. DiSalvatore resigned from the bar in part over fake expenses totalling $109,000. Stephen Gillers, a professor of legal ethics at New York University School of Law, said such cases appeared to be on the rise but said they remained "head-scratchers" to scholars in his field because the sums involved, even at six figures, were usually puny next to the partners' compensation. "We don't understand why anyone would jeopardize their position and achievements for what amounts to pocket change for partners at large American firms," he said.

Sullivan & Cromwell is one of the most profitable and prestigious corporate law firms in the country. Last year, the firm had profits per partner of $3.1 million, the third-highest in the nation, according to the AmLaw 100 survey by The American Lawyer magazine, a Law Journal affiliate. The firm also recently has been at the center of activity in the current turmoil on Wall Street, representing American International Group and Lehman Brothers, among others. Mr. Gillers said the dominant theory among legal ethics scholars was that highly paid partners who engage in such fraud are expressing anger, possibly against firms they feel should pay them still more or clients whose vastly greater wealth generates resentment. In his affidavit, Mr. Spinelli-Noseda said his misconduct typically involved characterizing personal travel and entertainment expenses as either client-related or business development. Though based in New York, Mr. Spinelli-Noseda specialized in Latin American transactions and was regarded as one of the region's top deal lawyers. He said in his affidavit that his conduct affected five clients. The firm would not identify them. Mr. Spinelli-Noseda has previously represented a variety of U.S. and Latin American financial institutions, as well as companies operating in the region. Permitted by clients to fly first-class on international flights, Mr. Spinelli-Noseda said he sometimes flew economy or business-class, pocketing the difference from the first-class fare he would invoice.

To claim personal meals and lodging as business development expenses, Mr. Spinelli-Noseda said he would sometimes "list the names of business colleagues who were not actually present at these events and collect reimbursement from the Firm for expenses that the Firm would not have paid had it known the truth." In some cases, Mr. Spinelli-Noseda said, he submitted expenses for flights he did not take and meals he never ate. According to the affidavit, one Sullivan & Cromwell associate participated in the expense fraud with Mr. Spinelli-Noseda. The ex-partner said he submitted fake expenses on behalf of an unidentified non-New York-based associate and then passed back to the associate a portion of the proceeds. Mr. Spinelli-Noseda said he understood this associate was no longer at the firm. A spokesman for Sullivan & Cromwell declined to comment on the associate described in the affidavit. Mr. Spinelli-Noseda said he reported his misconduct to the firm on March 16 because he became concerned that his expenses might be audited. He reported himself to the disciplinary committee four days later. Anthony. Lin@incisivemedia.com

The New York Law Journal by Anthony Lin - September 24, 2008

A former Sullivan & Cromwell partner has resigned from the bar for billing his clients and firm more than $500,000 in fraudulent travel and entertainment expenses. Carlos J. Spinelli-Noseda, a banking and finance specialist who joined Sullivan & Cromwell straight out of Harvard Law School in 1994 and became a partner in 2003, was facing a disciplinary investigation over a pattern of improper billing dating from roughly July 1998 to February 2008. In a June 3 affidavit of resignation he submitted to the disciplinary committee of the First Department, Mr. Spinelli-Noseda admitted he could not successfully defend himself against charges of professional misconduct. Such resignations are frequently tendered when further proceedings are almost certain to lead to disbarment. "I acknowledge that my actions violated the New York Lawyer's Code of Professional Responsibility, notably DR 1-102(A)(4) inasmuch as my conduct constituted dishonesty, fraud, deceit and misrepresentation," he stated in the affidavit, "and DR 1-102(A)(7) inasmuch as my conduct adversely reflects on my fitness and integrity as a lawyer." The Appellate Division, First Department, yesterday accepted Mr. Spinelli-Noseda's resignation on the disciplinary committee's motion In the Matter of Carlos J. Spinelli-Noseda, M-2908.

Mr. Spinelli-Noseda stepped down from his position at Sullivan & Cromwell in March. In a statement the firm said: "Upon discovery, the matter was promptly referred to the appropriate authorities. The Firm fully cooperated with those authorities, contacted affected clients and made restitution." Mr. Spinelli-Noseda's lawyer, John B. Harris of Stillman, Friedman & Shechtman, said his client "deeply regrets" his conduct and had pledged to repay the firm. "In cooperation with his former law firm, he has fully identified all of his improperly submitted expenses and is working to make all appropriate restitution," said Mr. Harris. Mr. Spinelli-Noseda, who is in his late 30s, is the latest large firm partner to engage in expense fraud.

Earlier this year, Samuel A. Fishman, a former Latham & Watkins partner pleaded guilty to criminal fraud charges after submitting around $300,000 in fake expenses. In 2006, former Wilmer Cutler Pickering Hale and Dorr intellectual property partner William P. DiSalvatore resigned from the bar in part over fake expenses totalling $109,000. Stephen Gillers, a professor of legal ethics at New York University School of Law, said such cases appeared to be on the rise but said they remained "head-scratchers" to scholars in his field because the sums involved, even at six figures, were usually puny next to the partners' compensation. "We don't understand why anyone would jeopardize their position and achievements for what amounts to pocket change for partners at large American firms," he said.

Sullivan & Cromwell is one of the most profitable and prestigious corporate law firms in the country. Last year, the firm had profits per partner of $3.1 million, the third-highest in the nation, according to the AmLaw 100 survey by The American Lawyer magazine, a Law Journal affiliate. The firm also recently has been at the center of activity in the current turmoil on Wall Street, representing American International Group and Lehman Brothers, among others. Mr. Gillers said the dominant theory among legal ethics scholars was that highly paid partners who engage in such fraud are expressing anger, possibly against firms they feel should pay them still more or clients whose vastly greater wealth generates resentment. In his affidavit, Mr. Spinelli-Noseda said his misconduct typically involved characterizing personal travel and entertainment expenses as either client-related or business development. Though based in New York, Mr. Spinelli-Noseda specialized in Latin American transactions and was regarded as one of the region's top deal lawyers. He said in his affidavit that his conduct affected five clients. The firm would not identify them. Mr. Spinelli-Noseda has previously represented a variety of U.S. and Latin American financial institutions, as well as companies operating in the region. Permitted by clients to fly first-class on international flights, Mr. Spinelli-Noseda said he sometimes flew economy or business-class, pocketing the difference from the first-class fare he would invoice.

To claim personal meals and lodging as business development expenses, Mr. Spinelli-Noseda said he would sometimes "list the names of business colleagues who were not actually present at these events and collect reimbursement from the Firm for expenses that the Firm would not have paid had it known the truth." In some cases, Mr. Spinelli-Noseda said, he submitted expenses for flights he did not take and meals he never ate. According to the affidavit, one Sullivan & Cromwell associate participated in the expense fraud with Mr. Spinelli-Noseda. The ex-partner said he submitted fake expenses on behalf of an unidentified non-New York-based associate and then passed back to the associate a portion of the proceeds. Mr. Spinelli-Noseda said he understood this associate was no longer at the firm. A spokesman for Sullivan & Cromwell declined to comment on the associate described in the affidavit. Mr. Spinelli-Noseda said he reported his misconduct to the firm on March 16 because he became concerned that his expenses might be audited. He reported himself to the disciplinary committee four days later. Anthony. Lin@incisivemedia.com

Tuesday, September 23, 2008

Officer of Court Fails at Attempt to Blame Casinos for Escrow Fraud

Gambler's $20M lawsuit against casinos tossed

The Associated Press by Wayne Parry - September 22, 2008

ATLANTIC CITY, N.J. -- A federal judge has dismissed a $20 million racketeering lawsuit against seven casinos by a former New York City attorney who said they had a duty to stop her from gambling. In a ruling issued Friday, U.S. District Court Judge Renee Bumb wrote that Arelia Margarita Taveras failed to support her claim that gambling is a hazardous endeavor worthy of special protections. "Playing blackjack, roulette or the slots bears no likeness to dumping toxic waste," the judge wrote. "She spent money on the bona fide chance that she might win more money. In short, she gambled." Taveras, who now lives in Minnesota, argued that the casinos saw she clearly had a gambling addiction yet did nothing to stop it. She said she gambled nonstop for days at a time in the casinos, and lost close to $1 million in less than two years. Taveras said she plans to appeal the dismissal. "New Jersey does not recognize that casinos have a duty of care to gamblers, and people are dying because of it," Taveras said Monday, moments after learning of the decision.

Taveras told The Associated Press she dipped into escrow accounts she maintained for clients to finance her gambling habit. She was disbarred in June 2007 and faces criminal charges stemming from those actions, but said she is trying to work out restitution agreements in order to avoid prison. Her lawsuit had named Resorts Atlantic City, Trump Plaza Hotel and Casino, Trump Taj Mahal Casino Resort, the Tropicana Casino Resort, the Showboat Casino Hotel, Bally's Atlantic City, as well as the MGM Grand Hotel and Casino in Las Vegas. The casinos denied any wrongdoing, claiming in court papers that Taveras brought her problems on herself. In a written statement, Resorts where Taveras said she did most of her gambling said, "The judge rendered an excellent decision consistent with New Jersey law."

The Associated Press by Wayne Parry - September 22, 2008

ATLANTIC CITY, N.J. -- A federal judge has dismissed a $20 million racketeering lawsuit against seven casinos by a former New York City attorney who said they had a duty to stop her from gambling. In a ruling issued Friday, U.S. District Court Judge Renee Bumb wrote that Arelia Margarita Taveras failed to support her claim that gambling is a hazardous endeavor worthy of special protections. "Playing blackjack, roulette or the slots bears no likeness to dumping toxic waste," the judge wrote. "She spent money on the bona fide chance that she might win more money. In short, she gambled." Taveras, who now lives in Minnesota, argued that the casinos saw she clearly had a gambling addiction yet did nothing to stop it. She said she gambled nonstop for days at a time in the casinos, and lost close to $1 million in less than two years. Taveras said she plans to appeal the dismissal. "New Jersey does not recognize that casinos have a duty of care to gamblers, and people are dying because of it," Taveras said Monday, moments after learning of the decision.

Taveras told The Associated Press she dipped into escrow accounts she maintained for clients to finance her gambling habit. She was disbarred in June 2007 and faces criminal charges stemming from those actions, but said she is trying to work out restitution agreements in order to avoid prison. Her lawsuit had named Resorts Atlantic City, Trump Plaza Hotel and Casino, Trump Taj Mahal Casino Resort, the Tropicana Casino Resort, the Showboat Casino Hotel, Bally's Atlantic City, as well as the MGM Grand Hotel and Casino in Las Vegas. The casinos denied any wrongdoing, claiming in court papers that Taveras brought her problems on herself. In a written statement, Resorts where Taveras said she did most of her gambling said, "The judge rendered an excellent decision consistent with New Jersey law."

Monday, September 22, 2008

Request to Gov. Paterson to Confront Court Corruption

Integrity in the Courts

“Injustice anywhere is a threat to justice everywhere.” (Dr. Martin Luther King, Jr.)

September 22, 2008

The Honorable David Paterson,

Governor of The State of New York

The State Capital

Albany, New York 12224

via U.S. Mail & facsimile # 518-408-2549

RE: 1. The Establishment of The Commission on Court Oversight

2. The Appointment of Chief Judge Margarita Lopez Torres

Dear Governor Paterson:

Your gubernatorial presence has renewed the promise of hope to the great people of New York. We are encouraged by, and have long yearned for, your leadership in reforming the condition of avarice and corruption that exists within and about our state’s court system.

Our yearlong research has revealed a troubling state court “ethics” oversight structure that is itself corrupt. We have documented countless examples where the law, attorneys, litigants, state employees and, in fact, judges have been targeted for annihilation simply because of a political whim or from the vengeful, misguided desires of a few. Conversely, we have evidence of many outrageous and criminal acts by certain individuals within and about the state court system that have been substantively overlooked for no other reason than their favored position or political affiliation.

We believe that the New York State Commission on Judicial Conduct and the statewide attorney grievance committees are irreversibly corrupt. Accordingly, we respectfully request that you immediately establish a Commission on Court Oversight to investigate and hold public hearings so that formal findings and recommendations may be presented to your office and to state lawmakers.

Further, and in the interest of true court reform, we respectfully request that you immediately take whatever steps are necessary to ensure that the name of Judge Margarita Lopez Torres be presented to the State Commission on Judicial Nomination for insertion on the list of candidates to be considered for Chief Judge of the New York State Court of Appeals.

We also respectfully request that you meet with us so that we may personally present you with the findings from our research. Each of our 40 founding members have a one-page overview, along with supporting documentation, to formally begin the work of your Commission on Court Oversight.

We are confident that future generations will echo our gratitude of your restoration of our faith in our government and in our system of law.

Very truly yours.

Integrity in the Courts

206-426-3558 (tel & fax)

“Injustice anywhere is a threat to justice everywhere.” (Dr. Martin Luther King, Jr.)

September 22, 2008

The Honorable David Paterson,

Governor of The State of New York

The State Capital

Albany, New York 12224

via U.S. Mail & facsimile # 518-408-2549

RE: 1. The Establishment of The Commission on Court Oversight

2. The Appointment of Chief Judge Margarita Lopez Torres

Dear Governor Paterson:

Your gubernatorial presence has renewed the promise of hope to the great people of New York. We are encouraged by, and have long yearned for, your leadership in reforming the condition of avarice and corruption that exists within and about our state’s court system.

Our yearlong research has revealed a troubling state court “ethics” oversight structure that is itself corrupt. We have documented countless examples where the law, attorneys, litigants, state employees and, in fact, judges have been targeted for annihilation simply because of a political whim or from the vengeful, misguided desires of a few. Conversely, we have evidence of many outrageous and criminal acts by certain individuals within and about the state court system that have been substantively overlooked for no other reason than their favored position or political affiliation.

We believe that the New York State Commission on Judicial Conduct and the statewide attorney grievance committees are irreversibly corrupt. Accordingly, we respectfully request that you immediately establish a Commission on Court Oversight to investigate and hold public hearings so that formal findings and recommendations may be presented to your office and to state lawmakers.

Further, and in the interest of true court reform, we respectfully request that you immediately take whatever steps are necessary to ensure that the name of Judge Margarita Lopez Torres be presented to the State Commission on Judicial Nomination for insertion on the list of candidates to be considered for Chief Judge of the New York State Court of Appeals.

We also respectfully request that you meet with us so that we may personally present you with the findings from our research. Each of our 40 founding members have a one-page overview, along with supporting documentation, to formally begin the work of your Commission on Court Oversight.

We are confident that future generations will echo our gratitude of your restoration of our faith in our government and in our system of law.

Very truly yours.

Integrity in the Courts

206-426-3558 (tel & fax)

See also:

Sunday, September 21, 2008

Only 7 Federal Judges Have Been Removed

History on the side of accused judge; Only 7 have been removed from office

The Times-Picayune by Richard Rainey, East Jefferson bureau - September 21, 2088

U.S. District Judge Thomas Porteous admits he came to depend on alcohol to get through the day and that he was addicted to gambling. He does not deny that he submitted false statements in his personal bankruptcy, on his annual financial disclosure forms and on his application for a bank loan. He concedes that lawyer friends bailed him out of one financial jam after another over the years, even when they had cases pending in his court. His own attorney said Porteous deserves the public reprimand he received this month from his superiors. But Porteous now faces the prospect of the ultimate sanction, impeachment and possible removal from office, in an arena where the standard for conviction is high and the guidelines for booting a judge are open to considerable interpretation.

Federal judges are appointed for life, and the Constitution makes removal of one almost impossible. That's to keep one branch of government from unduly influencing another. Should the House of Representatives approve articles of impeachment against Porteous, he would advance to trial in the Senate, where two-thirds of the members present must agree before he can be convicted and kicked off the bench. To reach that point, members of Congress will have determined that Porteous ran afoul of an eight-word phrase in Article II of the Constitution, where removal from office is required for "treason, bribery or other high crimes and misdemeanors." It is a phrase that has long confounded scholars. "Now, that's been a problem for more than 200 years, and I don't think it's one we can solve," said Carl Tobias, a law professor at the University of Richmond.

Porteous' professional future rests with a special 12-member task force appointed this past week by the House Judiciary Committee. The group has until Jan. 2 to investigate, after which the full committee and then the full House could consider the case. His superiors, on the Judicial Council of the 5th Circuit Court of Appeals in New Orleans and the Judicial Conference of the United States, already have called for his impeachment. But Porteous, his defense team and four dissenting 5th Circuit judges say his caddish behavior is irrelevant when it comes to the Constitution. For the most part, they say, he gambled, drank and lied in his private affairs -- not as a judge. Removing him from office for what they consider private behavior could serve to tighten scrutiny of federal judges, legal analysts say. Only seven judges have been impeached and convicted in U.S. history, and only two of them for misconduct committed outside their official capacity on the bench, they said. Porteous, 62, of Metairie, would be the third.

Wrinkled Robe scrutiny

President Clinton nominated Porteous to the federal court in 1994, after he spent 10 years as an elected judge of the state's 24th Judicial District Court in Gretna. By 2002, when the FBI's Wrinkled Robe investigation of corruption at the Gretna courthouse became public knowledge, it was clear that Porteous, too, was under scrutiny. Two state judges and 12 other defendants were convicted of Wrinkled Robe crimes, but the U.S. Justice Department decided in 2007 not to charge Porteous with a crime.

Once the Justice Department backed off, the 5th Circuit's Judicial Council took up the case against him. The council accused him last fall of making false statements during his 2001 bankruptcy and violating the Bankruptcy Court's orders, lying on the annual disclosure statements that he filed as a judge, accepting cash and gifts from lawyers with cases in his court, lying on an application for a $5,000 bank loan and violating codes of conduct for judges. Of those, the allegation most directly related to Porteous' work as a judge is that he asked for and accepted money from three attorneys who were litigating a dispute about ownership of a Kenner hospital, said Arthur Hellman, a law professor with the University of Pittsburgh who has followed the Porteous case closely. As presiding judge, Porteous never disclosed his financial connections during the trial. Still, no one has demonstrated that Porteous tilted his rulings in exchange for cash, and Porteous has denied that notion. The attorneys were longtime friends of his. "All of my dealings with the attorneys . . . were as a friend to a friend," he wrote. "No gift was given as a lawyer to a judge." The rest of the Judicial Council's case against Porteous accuses him of lying on his bankruptcy forms, bank fraud, lying on his financial disclosure forms as a judge and violating the code of conduct for federal judges.

Dissenting opinions

Four judges on the 19-member Judicial Council deviated from the majority opinion. In a 49-page dissent, they argued that his conduct, however reprehensible, does not warrant impeachment. Judges James Dennis of Monroe, James Brady of Baton Rouge, Thad Heartfield of Port Arthur, Texas, and Tucker Melancon of Marksville cautioned that Porteous had not abused his office and that removing him would only ease the excisions of federal judges in the future. Writing the dissent, Dennis accused the Judicial Council majority of overstepping the Constitution to create "an anomalous and eccentric definition of an impeachable offense." The national Judicial Conference, led by Chief Justice John Roberts, reviewed the case against Porteous as well as the dissenting opinion and agreed that his actions warrant impeachment. Only two federal judges have been removed from office for actions outside the job, the most recent being Walter Nixon of the Southern District of Mississippi in 1989 for lying to a federal grand jury. The first was Harry Claiborne of Nevada in 1986 for tax evasion and remaining on the bench after his criminal conviction for tax evasion. "What the Claiborne case suggests is even if you don't have the evidence of soliciting and accepting the aid of lawyers, the other things add up to impeachable offenses," Hellman said. "How can you trust a person who's willing to lie on official documents?" Hellman said.

Political intrigue

Adding to the intrigue are the political trappings of the case. Unlike a criminal trial, where a jury of citizens usually decides a case while being guided by specific law, impeachment is enacted by politicians in the House and tried by politicians in the Senate. In addition, the four dissenting judges and Porteous were all nominated to the bench by President Clinton, a Democrat. Of the 15 judges in the Judicial Council's majority, 11 were nominated by Republican presidents, including 5th Circuit Chief Judge Edith Jones of Houston, a Reagan appointee; the other four are Clinton appointees.

Porteous' case had stalled in the Democratic-controlled House after the Judicial Conference recommended in June that Congress consider impeachment. But the 5th Circuit's release of previously confidential documents on Sept. 11, and the fact that Porteous is still collecting $169,300 a year in salary while he is stripped of hearing cases, likely prompted the House Judiciary Committee to form its task force, Hellman said. "Releasing everything this time, one of their main purposes was to prod the House into taking action," he said. "That nothing was done in June must have been very troubling to the judges." If the Judiciary Committee's task force finds evidence to go through with an impeachment, the House must first decide whether the 5th Circuit's public reprimand of Porteous and effective suspension, albeit while still collecting pay, suffices as punishment. "That's one of the reasons I think the suspensions is an argument that's not going to be taken very seriously at all," Hellman said of Porteous' continued salary. Lawmakers "don't want any future misbehaving judges thinking they might get away with a suspension." Richard Rainey can be reached at rrainey@timespicayune.com or 504.883.7052.

The Times-Picayune by Richard Rainey, East Jefferson bureau - September 21, 2088

U.S. District Judge Thomas Porteous admits he came to depend on alcohol to get through the day and that he was addicted to gambling. He does not deny that he submitted false statements in his personal bankruptcy, on his annual financial disclosure forms and on his application for a bank loan. He concedes that lawyer friends bailed him out of one financial jam after another over the years, even when they had cases pending in his court. His own attorney said Porteous deserves the public reprimand he received this month from his superiors. But Porteous now faces the prospect of the ultimate sanction, impeachment and possible removal from office, in an arena where the standard for conviction is high and the guidelines for booting a judge are open to considerable interpretation.

Federal judges are appointed for life, and the Constitution makes removal of one almost impossible. That's to keep one branch of government from unduly influencing another. Should the House of Representatives approve articles of impeachment against Porteous, he would advance to trial in the Senate, where two-thirds of the members present must agree before he can be convicted and kicked off the bench. To reach that point, members of Congress will have determined that Porteous ran afoul of an eight-word phrase in Article II of the Constitution, where removal from office is required for "treason, bribery or other high crimes and misdemeanors." It is a phrase that has long confounded scholars. "Now, that's been a problem for more than 200 years, and I don't think it's one we can solve," said Carl Tobias, a law professor at the University of Richmond.

Porteous' professional future rests with a special 12-member task force appointed this past week by the House Judiciary Committee. The group has until Jan. 2 to investigate, after which the full committee and then the full House could consider the case. His superiors, on the Judicial Council of the 5th Circuit Court of Appeals in New Orleans and the Judicial Conference of the United States, already have called for his impeachment. But Porteous, his defense team and four dissenting 5th Circuit judges say his caddish behavior is irrelevant when it comes to the Constitution. For the most part, they say, he gambled, drank and lied in his private affairs -- not as a judge. Removing him from office for what they consider private behavior could serve to tighten scrutiny of federal judges, legal analysts say. Only seven judges have been impeached and convicted in U.S. history, and only two of them for misconduct committed outside their official capacity on the bench, they said. Porteous, 62, of Metairie, would be the third.

Wrinkled Robe scrutiny

President Clinton nominated Porteous to the federal court in 1994, after he spent 10 years as an elected judge of the state's 24th Judicial District Court in Gretna. By 2002, when the FBI's Wrinkled Robe investigation of corruption at the Gretna courthouse became public knowledge, it was clear that Porteous, too, was under scrutiny. Two state judges and 12 other defendants were convicted of Wrinkled Robe crimes, but the U.S. Justice Department decided in 2007 not to charge Porteous with a crime.

Once the Justice Department backed off, the 5th Circuit's Judicial Council took up the case against him. The council accused him last fall of making false statements during his 2001 bankruptcy and violating the Bankruptcy Court's orders, lying on the annual disclosure statements that he filed as a judge, accepting cash and gifts from lawyers with cases in his court, lying on an application for a $5,000 bank loan and violating codes of conduct for judges. Of those, the allegation most directly related to Porteous' work as a judge is that he asked for and accepted money from three attorneys who were litigating a dispute about ownership of a Kenner hospital, said Arthur Hellman, a law professor with the University of Pittsburgh who has followed the Porteous case closely. As presiding judge, Porteous never disclosed his financial connections during the trial. Still, no one has demonstrated that Porteous tilted his rulings in exchange for cash, and Porteous has denied that notion. The attorneys were longtime friends of his. "All of my dealings with the attorneys . . . were as a friend to a friend," he wrote. "No gift was given as a lawyer to a judge." The rest of the Judicial Council's case against Porteous accuses him of lying on his bankruptcy forms, bank fraud, lying on his financial disclosure forms as a judge and violating the code of conduct for federal judges.

Dissenting opinions

Four judges on the 19-member Judicial Council deviated from the majority opinion. In a 49-page dissent, they argued that his conduct, however reprehensible, does not warrant impeachment. Judges James Dennis of Monroe, James Brady of Baton Rouge, Thad Heartfield of Port Arthur, Texas, and Tucker Melancon of Marksville cautioned that Porteous had not abused his office and that removing him would only ease the excisions of federal judges in the future. Writing the dissent, Dennis accused the Judicial Council majority of overstepping the Constitution to create "an anomalous and eccentric definition of an impeachable offense." The national Judicial Conference, led by Chief Justice John Roberts, reviewed the case against Porteous as well as the dissenting opinion and agreed that his actions warrant impeachment. Only two federal judges have been removed from office for actions outside the job, the most recent being Walter Nixon of the Southern District of Mississippi in 1989 for lying to a federal grand jury. The first was Harry Claiborne of Nevada in 1986 for tax evasion and remaining on the bench after his criminal conviction for tax evasion. "What the Claiborne case suggests is even if you don't have the evidence of soliciting and accepting the aid of lawyers, the other things add up to impeachable offenses," Hellman said. "How can you trust a person who's willing to lie on official documents?" Hellman said.

Political intrigue

Adding to the intrigue are the political trappings of the case. Unlike a criminal trial, where a jury of citizens usually decides a case while being guided by specific law, impeachment is enacted by politicians in the House and tried by politicians in the Senate. In addition, the four dissenting judges and Porteous were all nominated to the bench by President Clinton, a Democrat. Of the 15 judges in the Judicial Council's majority, 11 were nominated by Republican presidents, including 5th Circuit Chief Judge Edith Jones of Houston, a Reagan appointee; the other four are Clinton appointees.

Porteous' case had stalled in the Democratic-controlled House after the Judicial Conference recommended in June that Congress consider impeachment. But the 5th Circuit's release of previously confidential documents on Sept. 11, and the fact that Porteous is still collecting $169,300 a year in salary while he is stripped of hearing cases, likely prompted the House Judiciary Committee to form its task force, Hellman said. "Releasing everything this time, one of their main purposes was to prod the House into taking action," he said. "That nothing was done in June must have been very troubling to the judges." If the Judiciary Committee's task force finds evidence to go through with an impeachment, the House must first decide whether the 5th Circuit's public reprimand of Porteous and effective suspension, albeit while still collecting pay, suffices as punishment. "That's one of the reasons I think the suspensions is an argument that's not going to be taken very seriously at all," Hellman said of Porteous' continued salary. Lawmakers "don't want any future misbehaving judges thinking they might get away with a suspension." Richard Rainey can be reached at rrainey@timespicayune.com or 504.883.7052.

Saturday, September 20, 2008

Client-Stripper's private dancing Gets Lawyer Suspended

Stripper's private dancing lands DeKalb lawyer in hot water

State commission suspends him 15 months for accepting nude dances as partial payment for her legal fees, report says

The Chicago Tribune by Art Barnum - September 19, 2008

A DeKalb lawyer was suspended for 15 months Thursday for arranging to have a female client perform nude dances for him in exchange for credit on her legal fees, a state commission said. Scott Robert Erwin, a lawyer since 1980, will begin his suspension Oct. 7, according to the Illinois Attorney Registration and Disciplinary Commission, a branch of the state Supreme Court that conducts investigations into attorney misconduct. Erwin, with offices at 211 N. 1st St., has not been charged criminally. Erwin represented the female client and several of her family members on several different types of cases. The relationship began in 2001 at Heartbreakers, a Compton, Ill., strip club where, after Erwin talked to an exotic dancer, both realized they had talked to each other over the telephone about some pending legal matters, according to the commission's report of the allegations. Erwin agreed to represent her on several legal matters, and they mutually agreed that she perform nude dances for him in his office as a way to cut down on the legal fees, according to the report. She claimed that on several occasions from February to June in 2002 she would go to his office, remove her clothing and dance for half-hour sessions. She also claimed that Erwin continued to go to Heartbreakers, where he would pay the $15 entrance fee but wouldn't pay her for performing nude dances.

She claims during the dances at his office, he inappropriately touched her, the report states. He denied any such touching in police interviews. Erwin credited her for $534, but she complained because her bill had reached $7,000, the report states. The woman went to DeKalb police in 2002 about the sexual assault allegations, and an investigation led to a hearing before the DeKalb County grand jury in 2003, seeking a charge of criminal sexual assault. The grand jury did not vote for an indictment, the commission report states. When reached by phone Thursday, Erwin declined to comment. He has no prior disciplinary action from the state. He was a former chairman of the DeKalb County pro bono committee of the DeKalb County Bar Association, according to the commission documents. The woman, who is no longer an exotic dancer, is married with three children and is a real estate agent, according to the report. abarnum@tribune.com

State commission suspends him 15 months for accepting nude dances as partial payment for her legal fees, report says

The Chicago Tribune by Art Barnum - September 19, 2008

A DeKalb lawyer was suspended for 15 months Thursday for arranging to have a female client perform nude dances for him in exchange for credit on her legal fees, a state commission said. Scott Robert Erwin, a lawyer since 1980, will begin his suspension Oct. 7, according to the Illinois Attorney Registration and Disciplinary Commission, a branch of the state Supreme Court that conducts investigations into attorney misconduct. Erwin, with offices at 211 N. 1st St., has not been charged criminally. Erwin represented the female client and several of her family members on several different types of cases. The relationship began in 2001 at Heartbreakers, a Compton, Ill., strip club where, after Erwin talked to an exotic dancer, both realized they had talked to each other over the telephone about some pending legal matters, according to the commission's report of the allegations. Erwin agreed to represent her on several legal matters, and they mutually agreed that she perform nude dances for him in his office as a way to cut down on the legal fees, according to the report. She claimed that on several occasions from February to June in 2002 she would go to his office, remove her clothing and dance for half-hour sessions. She also claimed that Erwin continued to go to Heartbreakers, where he would pay the $15 entrance fee but wouldn't pay her for performing nude dances.

She claims during the dances at his office, he inappropriately touched her, the report states. He denied any such touching in police interviews. Erwin credited her for $534, but she complained because her bill had reached $7,000, the report states. The woman went to DeKalb police in 2002 about the sexual assault allegations, and an investigation led to a hearing before the DeKalb County grand jury in 2003, seeking a charge of criminal sexual assault. The grand jury did not vote for an indictment, the commission report states. When reached by phone Thursday, Erwin declined to comment. He has no prior disciplinary action from the state. He was a former chairman of the DeKalb County pro bono committee of the DeKalb County Bar Association, according to the commission documents. The woman, who is no longer an exotic dancer, is married with three children and is a real estate agent, according to the report. abarnum@tribune.com

Memories of Corrupt Judicial Cross-Endorsements

Democrats nominate 1 of their own for Supreme Court

The Albany Times Union by CAROL DeMARE - September 19, 2008