The New York Law Journal by Anthony E. Davis - January 3, 2011

As we enter a new year, yet again conflicts of interest issues continue to bedevil lawyers and law firms large and small. This article surveys three recent cases that address different aspects of the ethics rules and law governing conflicts of interest: representing clients adverse to affiliates of existing entity clients; the efficacy (or otherwise) of advance waivers; and, a case with overtones of Halloween that would make for humorous reading if it were not in reality about a very serious topic, the scope and meaning of "personal interest" conflicts.

Affiliates

In GSI Commerce Solutions Inc., v. BabyCenter, LLC, 2010 WL 3239436 (2d Cir. Aug. 18, 2010), the U.S. Court of Appeals for the Second Circuit provided important guidance to lawyers and law firms who customarily represent corporate and other entity clients, when they are called on to represent clients in matters that are adverse to an affiliate of another existing client. The plaintiffs, GSI Commerce Solutions, appealed from Judge Jed Rakoff's order granting a motion by the defendants, BabyCenter, a wholly owned subsidiary of Johnson & Johnson Inc. (J&J), to disqualify GSI's counsel. The firm representing GSI had represented J&J in other matters. Judge Rakoff had concluded that the doctrine forbidding concurrent representation without consent applied, because the relationship between BabyCenter and J&J was so close that the two were essentially one client for disqualification purposes. The District Court therefore disqualified the law firm from representing GSI because it had not obtained consent from J&J, its existing entity client. In affirming, the Second Circuit spelled out the criteria to be applied in making the determination in concurrent representation situations as to whether affiliates are to be treated as the same, or separate, entities for purposes of applying the rules governing conflicts of interest. The Second Circuit commenced its discussion of the applicable considerations by reiterating some basic principles: "Although the American Bar Association (ABA) and state disciplinary codes provide valuable guidance, a violation of those rules may not warrant disqualification. Instead, disqualification is warranted only if 'an attorney's conduct tends to taint the underlying trial.' One established ground for disqualification is concurrent representation, an attorney's simultaneous representation of one existing client in a matter adverse to another existing client. Because concurrent representation is 'prima facie improper,' it is incumbent upon the attorney to 'show, at the very least, that there will be no actual or apparent conflict in loyalties or diminution in the vigor of his representation.' We have noted that this is 'a burden so heavy that it will rarely be met.'" (Citations omitted). The court further noted that "representation adverse to a client's affiliate can, in certain circumstances, conflict with the lawyer's duty of loyalty owed to a client," a situation that we shall refer to as "a corporate affiliate conflict."

The Second Circuit then turned to the relevant factors in determining whether a corporate affiliate conflict exists:

As we enter a new year, yet again conflicts of interest issues continue to bedevil lawyers and law firms large and small. This article surveys three recent cases that address different aspects of the ethics rules and law governing conflicts of interest: representing clients adverse to affiliates of existing entity clients; the efficacy (or otherwise) of advance waivers; and, a case with overtones of Halloween that would make for humorous reading if it were not in reality about a very serious topic, the scope and meaning of "personal interest" conflicts.

Affiliates

In GSI Commerce Solutions Inc., v. BabyCenter, LLC, 2010 WL 3239436 (2d Cir. Aug. 18, 2010), the U.S. Court of Appeals for the Second Circuit provided important guidance to lawyers and law firms who customarily represent corporate and other entity clients, when they are called on to represent clients in matters that are adverse to an affiliate of another existing client. The plaintiffs, GSI Commerce Solutions, appealed from Judge Jed Rakoff's order granting a motion by the defendants, BabyCenter, a wholly owned subsidiary of Johnson & Johnson Inc. (J&J), to disqualify GSI's counsel. The firm representing GSI had represented J&J in other matters. Judge Rakoff had concluded that the doctrine forbidding concurrent representation without consent applied, because the relationship between BabyCenter and J&J was so close that the two were essentially one client for disqualification purposes. The District Court therefore disqualified the law firm from representing GSI because it had not obtained consent from J&J, its existing entity client. In affirming, the Second Circuit spelled out the criteria to be applied in making the determination in concurrent representation situations as to whether affiliates are to be treated as the same, or separate, entities for purposes of applying the rules governing conflicts of interest. The Second Circuit commenced its discussion of the applicable considerations by reiterating some basic principles: "Although the American Bar Association (ABA) and state disciplinary codes provide valuable guidance, a violation of those rules may not warrant disqualification. Instead, disqualification is warranted only if 'an attorney's conduct tends to taint the underlying trial.' One established ground for disqualification is concurrent representation, an attorney's simultaneous representation of one existing client in a matter adverse to another existing client. Because concurrent representation is 'prima facie improper,' it is incumbent upon the attorney to 'show, at the very least, that there will be no actual or apparent conflict in loyalties or diminution in the vigor of his representation.' We have noted that this is 'a burden so heavy that it will rarely be met.'" (Citations omitted). The court further noted that "representation adverse to a client's affiliate can, in certain circumstances, conflict with the lawyer's duty of loyalty owed to a client," a situation that we shall refer to as "a corporate affiliate conflict."

The Second Circuit then turned to the relevant factors in determining whether a corporate affiliate conflict exists:

Courts have generally focused on: (i) the degree of operational commonality between affiliated entities, and (ii) the extent to which one depends financially on the other. As to operational commonality, courts have considered the extent to which entities rely on a common infrastructure. Courts have also focused on the extent to which the affiliated entities rely on or otherwise share common personnel such as managers, officers, and directors. In this respect, courts have emphasized the extent to which affiliated entities share responsibility for both the provision and management of legal services. This focus on shared or dependent control over legal and management issues reflects the view that neither management nor in-house legal counsel should, without their consent, have to place their trust in outside counsel in one matter while opposing the same counsel in another. As to financial interdependence, several courts have considered the extent to which an adverse outcome in the matter at issue would result in substantial and measurable loss to the client or its affiliate. Courts have also inquired into the entities' ownership structure… [W]e agree with the ABA that affiliates should not be considered a single entity for conflicts purposes based solely on the fact that one entity is a wholly-owned subsidiary of the other, at least when the subsidiary is not otherwise operationally integrated with the parent company.

Applying these general principles to the case at bar, the Second Circuit concluded that:

Applying these general principles to the case at bar, the Second Circuit concluded that:

the record established such substantial operational commonalty between BabyCenter and J&J that the district court's decision to treat the two entities as one client was easily within its ample discretion.… When considered together, [the factors considered by Judge Rakoff] show that the relationship between the two entities is exceedingly close. That showing in turn substantiates the view that the law firm, by representing GSI in this matter, 'reasonably diminishes the level of confidence and trust in counsel held by' J&J. Finally, in affirming the law firm's disqualification, the Second Circuit expressly found that the firm had failed to obtain J&J's consent to the specific corporate affiliate conflict at issue in the case.

Advance Waivers

In Brigham Young University, v. Pfizer Inc., et al., 2010 WL 3855347 (D. Utah), Sept. 29, 2010, the District Court addressed an issue that lies at the heart of many of the cases that deal with the validity of advance waivers of conflicts of interest, namely, what constitutes adequate disclosure of potential future conflicts in a law firm's engagement letter in order to avoid subsequent disqualification? In this case, the District Court upheld the decision of a Magistrate Judge in favor of Brigham Young University, disqualifying the law firm from representing defendant Pfizer in litigation with the university. The District Court agreed with the Magistrate that the advance patent waiver set forth in a 2001 engagement letter between the university and the law firm did not apply to the specific conflict which had arisen in this case, thereby negating the firm's argument that the university had previously waived this conflict. The court also agreed that the law firm's violation of Utah's Rule of Professional Conduct 1.7 was sufficiently egregious to merit disqualification.

The law firm had included the following language in its 2001 engagement letter with the university:

Advance Patent Waiver: As you may know, universities frequently hold patents in the products and inventions developed at such universities. [The firm] currently represents multiple pharmaceutical and other companies with respect to patent and intellectual property matters (collectively, the "Other Clients"), including litigation (the "Patent Matters"). [The firm] is not currently representing any Other Clients in matters adverse to the University. Because of the scope of our patent practice, however, it is possible that [the firm] will be asked in the future to represent one or more Other Clients in matters, including litigation, adverse to the University. Therefore, as a condition to [the firm's] undertaking to represent you in the BYU Matters, you agree that this firm may continue to represent Other Clients in the Patent Matters, including litigation, directly adverse to the University and hereby waive any conflict of interest relating to such representation of Other Clients.

The term "Other Clients" was defined within the waiver provision to mean "companies that [the firm] currently represents 'with respect to patents and intellectual property matters.'" The District Court accepted the Magistrate Judge's conclusion that, as a result of this language, the "waiver only applies to clients that [the firm] was representing with respect to patent and intellectual property matters as of the date of the agreement." The firm argued that this was an inappropriately narrow and unreasonable interpretation of the engagement letter, and that the advance patent waiver validly covered all "existing clients" in matters relating to intellectual property and patents, including litigation. In disagreeing, the District Court noted that when evaluating waivers, courts should look primarily to construction of the waiver language to determine its validity. For consent to be interpreted as validly waiving the client's right to exclusive representation, "[l]anguage in a contract of release…would have to be positive, unequivocal and inconsistent with any other interpretation." Where the terms of a waiver are not sufficiently explicit, as in this case, the client should not be held to the terms of the document. Accordingly, the District Court upheld the Magistrate Judge's disqualification of the firm. Both this and the GSI Commerce Solutions case demonstrate just how hard it is for lawyers and law firms to foresee the precise conflict that an advance waiver is supposed to encompass, and also how at least some courts hold that unless the disclosure actually does predict with absolute clarity the exact conflict to be waived, the disclosure, and hence the waiver, will fail. In the last analysis, so long as the ethics rules are predicated on the principle that loyalty is owed to a client overall, and not just to an individual engagement (as is the case in many other countries), and so long as courts so interpret the rules, law firms have no choice but to accept that the best that can be said of advance waivers of conflicts is that they represent hopes, not certainties.

'Personal Interest' Conflicts

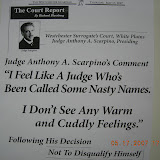

In a case that more properly belongs to Halloween than New Year, In re Charna R. Johnson, respondent, member of the State Bar of Arizona, Disciplinary Commission of the Supreme Court of Arizona No. 09-0717, was a professional discipline case that addressed the tangled web of self-interest conflicts of interest. The respondent attorney was alleged by the Arizona disciplinary authorities to have had an inappropriate relationship with a client, whom she was originally retained to represent in a divorce, and she was also charged with lying about the facts and circumstances of the underlying complaint in the course of defending herself from a second unrelated complaint arising from a different client engagement. The allegedly improper relationship began after the client's wife died, when respondent began to "channel" the wife's spirit, purportedly communicating her thoughts and feelings to her former husband. The client testified that shortly after his wife died, in the course of this "channeling," the respondent, acting as his late wife, told him she loved him and pressured him to have sex. He believed his late wife's spirit had come back to try and heal some of the damage caused by her drug use. Though his wife's death ended the respondent's representation of the client to obtain a divorce, the client asked her to represent him again in a dispute over the wife's probate estate. The estate matter ended in a settlement that was very beneficial to the client, but he later claimed he was unhappy with it and that the respondent's conduct harmed him emotionally and financially.

The allegation that respondent lied to the bar authorities arose from a second, separate matter in which it had been alleged that the respondent improperly drafted the will of the ex-wife of respondent's client, in which the ex-wife left her estate to the respondent. The complainant in this matter asserted that respondent had asserted undue influence on his ex-wife by claiming to channel the thoughts of her client's deceased loved ones. In connection with this second matter, the respondent and the bar entered into a consent decree in which the agreed sanction was censure and probation. However, the complainant in this case did not believe that censure was adequate punishment. He appeared at the hearing at which the consent resolution was to be finalized with a letter, which prompted bar counsel to ask the respondent whether she had "ever 'channeled' a person for one of [her] clients" and whether she does "any 'channeling' of deceased persons." Respondent answered 'no' to both questions. Those answers formed the basis for the allegation that the respondent had lied to the bar authorities. The respondent defended the charge that she had lied by stating that she did not consider her communications for the former client's deceased wife's spirit to be 'channeling.' She also claimed that the questions did not bring to mind the former circumstances, because the experience had been so painful that she blocked it out. With respect to the inappropriate relationship charge, the hearing officer found that there was not enough evidence to prove that a sexual relationship occurred during the respondent's representation. He noted that the client encouraged the respondent's "channeling" of his late wife, and found that although there was a "significant risk that Respondent's representation could have been materially limited" by the unique relationship, there was no evidence that the client was harmed financially or emotionally. However, the hearing officer found that the respondent had lied about her behavior in defending herself in connection with the other case, and on that dishonesty charge the respondent was suspended for two years. This case demonstrates that it is sometimes difficult for lawyers to recognize a personal interest conflict of interest, and how important it can be to seek disinterested advice as to how to proceed when lawyers do become aware of the existence of such conflicts. In this case, the lawyer was evidently too distracted by her own problems to recognize the need for guidance before engaging with her client either in the relationship or the other activities. Lawyers without professional peers to turn to for objective advice should consider adopting a bright-line rule: if there is any personal interest or involvement with a client, avoid the representation. Anthony E. Davis, a partner at Hinshaw & Culbertson, is a past president of the Association of Professional Responsibility Lawyers.

Advance Waivers

In Brigham Young University, v. Pfizer Inc., et al., 2010 WL 3855347 (D. Utah), Sept. 29, 2010, the District Court addressed an issue that lies at the heart of many of the cases that deal with the validity of advance waivers of conflicts of interest, namely, what constitutes adequate disclosure of potential future conflicts in a law firm's engagement letter in order to avoid subsequent disqualification? In this case, the District Court upheld the decision of a Magistrate Judge in favor of Brigham Young University, disqualifying the law firm from representing defendant Pfizer in litigation with the university. The District Court agreed with the Magistrate that the advance patent waiver set forth in a 2001 engagement letter between the university and the law firm did not apply to the specific conflict which had arisen in this case, thereby negating the firm's argument that the university had previously waived this conflict. The court also agreed that the law firm's violation of Utah's Rule of Professional Conduct 1.7 was sufficiently egregious to merit disqualification.

The law firm had included the following language in its 2001 engagement letter with the university:

Advance Patent Waiver: As you may know, universities frequently hold patents in the products and inventions developed at such universities. [The firm] currently represents multiple pharmaceutical and other companies with respect to patent and intellectual property matters (collectively, the "Other Clients"), including litigation (the "Patent Matters"). [The firm] is not currently representing any Other Clients in matters adverse to the University. Because of the scope of our patent practice, however, it is possible that [the firm] will be asked in the future to represent one or more Other Clients in matters, including litigation, adverse to the University. Therefore, as a condition to [the firm's] undertaking to represent you in the BYU Matters, you agree that this firm may continue to represent Other Clients in the Patent Matters, including litigation, directly adverse to the University and hereby waive any conflict of interest relating to such representation of Other Clients.

The term "Other Clients" was defined within the waiver provision to mean "companies that [the firm] currently represents 'with respect to patents and intellectual property matters.'" The District Court accepted the Magistrate Judge's conclusion that, as a result of this language, the "waiver only applies to clients that [the firm] was representing with respect to patent and intellectual property matters as of the date of the agreement." The firm argued that this was an inappropriately narrow and unreasonable interpretation of the engagement letter, and that the advance patent waiver validly covered all "existing clients" in matters relating to intellectual property and patents, including litigation. In disagreeing, the District Court noted that when evaluating waivers, courts should look primarily to construction of the waiver language to determine its validity. For consent to be interpreted as validly waiving the client's right to exclusive representation, "[l]anguage in a contract of release…would have to be positive, unequivocal and inconsistent with any other interpretation." Where the terms of a waiver are not sufficiently explicit, as in this case, the client should not be held to the terms of the document. Accordingly, the District Court upheld the Magistrate Judge's disqualification of the firm. Both this and the GSI Commerce Solutions case demonstrate just how hard it is for lawyers and law firms to foresee the precise conflict that an advance waiver is supposed to encompass, and also how at least some courts hold that unless the disclosure actually does predict with absolute clarity the exact conflict to be waived, the disclosure, and hence the waiver, will fail. In the last analysis, so long as the ethics rules are predicated on the principle that loyalty is owed to a client overall, and not just to an individual engagement (as is the case in many other countries), and so long as courts so interpret the rules, law firms have no choice but to accept that the best that can be said of advance waivers of conflicts is that they represent hopes, not certainties.

'Personal Interest' Conflicts

In a case that more properly belongs to Halloween than New Year, In re Charna R. Johnson, respondent, member of the State Bar of Arizona, Disciplinary Commission of the Supreme Court of Arizona No. 09-0717, was a professional discipline case that addressed the tangled web of self-interest conflicts of interest. The respondent attorney was alleged by the Arizona disciplinary authorities to have had an inappropriate relationship with a client, whom she was originally retained to represent in a divorce, and she was also charged with lying about the facts and circumstances of the underlying complaint in the course of defending herself from a second unrelated complaint arising from a different client engagement. The allegedly improper relationship began after the client's wife died, when respondent began to "channel" the wife's spirit, purportedly communicating her thoughts and feelings to her former husband. The client testified that shortly after his wife died, in the course of this "channeling," the respondent, acting as his late wife, told him she loved him and pressured him to have sex. He believed his late wife's spirit had come back to try and heal some of the damage caused by her drug use. Though his wife's death ended the respondent's representation of the client to obtain a divorce, the client asked her to represent him again in a dispute over the wife's probate estate. The estate matter ended in a settlement that was very beneficial to the client, but he later claimed he was unhappy with it and that the respondent's conduct harmed him emotionally and financially.

The allegation that respondent lied to the bar authorities arose from a second, separate matter in which it had been alleged that the respondent improperly drafted the will of the ex-wife of respondent's client, in which the ex-wife left her estate to the respondent. The complainant in this matter asserted that respondent had asserted undue influence on his ex-wife by claiming to channel the thoughts of her client's deceased loved ones. In connection with this second matter, the respondent and the bar entered into a consent decree in which the agreed sanction was censure and probation. However, the complainant in this case did not believe that censure was adequate punishment. He appeared at the hearing at which the consent resolution was to be finalized with a letter, which prompted bar counsel to ask the respondent whether she had "ever 'channeled' a person for one of [her] clients" and whether she does "any 'channeling' of deceased persons." Respondent answered 'no' to both questions. Those answers formed the basis for the allegation that the respondent had lied to the bar authorities. The respondent defended the charge that she had lied by stating that she did not consider her communications for the former client's deceased wife's spirit to be 'channeling.' She also claimed that the questions did not bring to mind the former circumstances, because the experience had been so painful that she blocked it out. With respect to the inappropriate relationship charge, the hearing officer found that there was not enough evidence to prove that a sexual relationship occurred during the respondent's representation. He noted that the client encouraged the respondent's "channeling" of his late wife, and found that although there was a "significant risk that Respondent's representation could have been materially limited" by the unique relationship, there was no evidence that the client was harmed financially or emotionally. However, the hearing officer found that the respondent had lied about her behavior in defending herself in connection with the other case, and on that dishonesty charge the respondent was suspended for two years. This case demonstrates that it is sometimes difficult for lawyers to recognize a personal interest conflict of interest, and how important it can be to seek disinterested advice as to how to proceed when lawyers do become aware of the existence of such conflicts. In this case, the lawyer was evidently too distracted by her own problems to recognize the need for guidance before engaging with her client either in the relationship or the other activities. Lawyers without professional peers to turn to for objective advice should consider adopting a bright-line rule: if there is any personal interest or involvement with a client, avoid the representation. Anthony E. Davis, a partner at Hinshaw & Culbertson, is a past president of the Association of Professional Responsibility Lawyers.