Judicial 'Ethics' Chief Counsel Robert Tembeckjian's Sexless Money Grab

MLK said: "Injustice Anywhere is a Threat to Justice Everywhere"

End Corruption in the Courts!

Court employee, judge or citizen - Report Corruption in any Court Today !! As of June 15, 2016, we've received over 142,500 tips...KEEP THEM COMING !! Email: CorruptCourts@gmail.com

Most Read Stories

- Tembeckjian's Corrupt Judicial 'Ethics' Commission Out of Control

- As NY Judges' Pay Fiasco Grows, Judicial 'Ethics' Chief Enjoys Public-Paid Perks

- New York Judges Disgraced Again

- Wall Street Journal: When our Trusted Officials Lie

- Massive Attorney Conflict in Madoff Scam

- FBI Probes Threats on Federal Witnesses in New York Ethics Scandal

- Federal Judge: "But you destroyed the faith of the people in their government."

- Attorney Gives New Meaning to Oral Argument

- Wannabe Judge Attorney Writes About Ethical Dilemmas SHE Failed to Report

- 3 Judges Covered Crony's 9/11 Donation Fraud

- Former NY State Chief Court Clerk Sues Judges in Federal Court

- Concealing the Truth at the Attorney Ethics Committee

- NY Ethics Scandal Tied to International Espionage Scheme

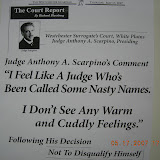

- Westchester Surrogate's Court's Dastardly Deeds

Sunday, December 2, 2012

As NY Judges' Pay Fiasco Grows, Judicial 'Ethics' Chief Enjoys Public-Paid Perks

Saturday, December 1, 2012

New York Judges Disgraced Again

The Corrupt Court Machine Strikes Again

Wednesday, November 14, 2012

White House Petition to Withdraw Jonathan Lippman Nomination

White House Petition to Withdraw Jonathan Lippman Nomination

Tuesday, September 11, 2012

Monday, September 10, 2012

Saturday, September 8, 2012

Friday, September 7, 2012

Thursday, September 6, 2012

Wednesday, September 5, 2012

Tuesday, September 4, 2012

Monday, September 3, 2012

Sunday, September 2, 2012

Saturday, September 1, 2012

Ex-Lawyer Charged With Attempted Murder

Thursday, August 16, 2012

New York FBI Chief to Retire

FBI - NEW YORK FIELD OFFICE PRESS RELEASE - New York FBI Chief to Retire

Tuesday, August 14, 2012

Call To Action Alert #2

Call To Action Alert #2

Monday, August 13, 2012

Call To Action Alert #1

Call To Action Alert #1

Monday, July 9, 2012

Another Mortgage Crisis Cover-Up, Another Lawyer-Judge Protecting Insiders

Friday, July 6, 2012

Ethics Corruption Attorney Asks Governor to Request Federal Intervention

Ethics Corruption Attorney Asks Governor to Request Federal Intervention

CLICK HERE TO SEE THE STORY

CLICK HERE TO SEE THE STORY

Thursday, July 5, 2012

More Filings in NY's Federal Ethics Scandal Case

More Filings in NY's Federal Ethics Scandal Case.....

CLICK HERE TO SEE THE PAPERS ENTERED JULY 3, 2012....

CLICK HERE TO SEE THE PAPERS ENTERED JULY 3, 2012....

Wednesday, June 27, 2012

NY Legal Ethics Scandal Whistleblower Back in Federal Court

NY Legal Ethics Scandal Whistleblower Back in Federal Court

Witness Tampering Brings NY Attorney Christine Anderson Back to Federal Court

Widespread 'Ethics' Corruption Now Includes Threat on Witness in a Federal Proceeding

CLICK HERE TO SEE THE STORY AND THE JUNE 25, 2012 FILED PAPERS

Witness Tampering Brings NY Attorney Christine Anderson Back to Federal Court

Widespread 'Ethics' Corruption Now Includes Threat on Witness in a Federal Proceeding

CLICK HERE TO SEE THE STORY AND THE JUNE 25, 2012 FILED PAPERS

Tuesday, June 12, 2012

Wednesday, June 6, 2012

Insight Into Corruption-Protection At Top Law Firms

Former Attorney Gets Record Insider-Trading Sentence

The American Lawyer by Tom Huddleston Jr. - June 6, 2012

Former attorney Matthew Kluger was sentenced on June 4 to 12 years in prison for his role in a massive insider-trading scheme that carried on for nearly two decades and was made possible in large part by his position as an associate with a series of Am Law 100 firms. According to Bloomberg, his prison term is the longest ever imposed for insider trading, exceeding the 11-year sentence given last year to Galleon Group co-founder Raj Rajaratnam. Prosecutors say the scheme netted a combined total of more than $37 million in illicit gains for the 51-year-old Kluger—who, based on federal sentencing guidelines, faced between 11 and 14 years in prison—and his two collaborators: former stock trader Garrett Bauer and mortgage broker Kenneth Robinson. In handing down what she acknowledged was a harsh sentence, U.S. District Court Judge Katharine Hayden in Newark, N.J., said that Kluger's crime warranted such a stiff penalty because "it allows greedy, arrogant people to make money off others." In a statement to the court, Kluger expressed remorse for his actions. He said he wanted the court to know "how terribly, terribly sorry I am." He also expressed a desire to make reparations to some of those he wronged along the way. "I will do anything I can to try and regain a modicum of the trust that I destroyed [with] so many people and so many institutions," he said.

The sentencing comes a little more than one year after prosecutors accused Kluger in a federal complaint of participating in the insider-trading ring. Kluger pleaded guilty to all four counts against him, including conspiracy to commit securities fraud, securities fraud, conspiracy to commit money laundering, and obstruction of justice (NYLJ, Dec. 16, 2011). The three-man operation kicked off in 1994, according to Robinson's court testimony, when Kluger was a summer associate at Cravath, Swaine & Moore, and continued as he moved on to associate positions at Skadden, Arps, Slate, Meagher & Flom; Fried, Frank, Harris, Shriver & Jacobson; and, finally, Wilson Sonsini Goodrich & Rosati. Kluger stole confidential information related to corporate transactional work being handled by his employer at each stop, then passed details of pending corporate mergers to Robinson, the scheme's middleman. Robinson would then pass the details on to Bauer, who would then use the inside information to purchase shares for all three men, according to Robinson's testimony.

Across the span of the roughly 17-year scheme, Kluger and his cohorts traded ahead of more than 30 separate transactions, prosecutors say. In December, as part of a settlement agreement with the U.S. Securities and Exchange Commission, the three men agreed to repay their illegal profits from the conspiracy. Prosecutors have said that Bauer took the "lion's share of the profits," which is why the former trader was required earlier this year to forfeit roughly $31.6 million. For his part, Kluger agreed to forfeit $516,000. Robinson will pay $845,000. In court on June 4, Kluger's attorney, Alan Zegas of Chatham, N.J., argued that his client was insulated from Bauer during the course of the conspiracy and was misled by his co-conspirators as to the amount of stock being purchased as a result of the inside information he was passing along. According to Zegas, Kluger claims the three men began the scheme with an agreement to split all proceeds equally, and that Kluger would have ceased providing the inside information had he known Bauer planned on purchasing a higher volume of stock. Assistant U.S. Attorney Judith Germano made it clear during the sentencing that the government didn't accept Kluger's claims of what she called a "loosey-goosey agreement" between the trio to split their gains three ways. Zegas used his client's supposed ignorance about the scope of the scheme to argue for a lighter sentence, even going so far as to ask that Hayden delay sentencing until a hearing could be scheduled to weigh additional evidence he said would establish his client's ignorance about the scope of Bauer's trading activities. The judge refused that request. After being sentenced, Kluger told a group of reporters that he had been forthcoming with the government since the time of his arrest and reiterated his belief that further discovery would reveal that his cohorts deliberately withheld information from him throughout the scheme. "A hearing with Ken Robinson on the stand…he would have admitted to doing things on each deal actively to mislead me," Kluger said. Zegas told reporters that he is considering appealing the sentence.

Recorded Conversations - The case came together after Robinson agreed to cooperate with prosecutors and recorded several conversations with Kluger whose contents were contained in a criminal complaint filed against the former lawyer. Robinson pleaded guilty last April to one count of conspiracy to commit securities fraud and two counts of securities fraud. Like Kluger, Bauer pleaded guilty in December to all four counts against him. Among the more interesting details of the case is the origin of obstruction of justice charges against Kluger and Bauer. In Kluger's case, he destroyed a computer and an iPhone upon learning that authorities had searched Robinson's home, according to court documents, while also instructing Robinson to destroy a prepaid cellphone that he had used to communicate with Kluger and Bauer. Meanwhile, Bauer's obstruction of justice charge came about after he broke his own prepaid cellphone into two pieces and tossed them in separate trash cans at a Manhattan McDonald's. Bauer was sentenced to nine years in prison on June 4, while Robinson got 27 months. Robinson received a shorter sentence due to his cooperation with authorities. (Since his arrest, Bauer has been telling his story to groups of people at such places as business schools and law schools, encouraging others not to follow his criminal path, Bloomberg reports.) For her part, Germano asserted that Kluger was the scheme's mastermind and that none of the illegal trading would have been possible without the insider information he stole from his employers. She also frequently returned to the fact that the scheme began while Kluger was just a summer associate—pointing out that he had already headed down a criminal path before he even became a full-time lawyer. "He was an attorney who had a duty of trust," she said, "a duty to uphold the confidence" of his clients and employers. @|Tom Huddleston Jr., a reporter for The American Lawyer, an affiliate, can be contacted at thuddleston@alm.com.

The American Lawyer by Tom Huddleston Jr. - June 6, 2012

Former attorney Matthew Kluger was sentenced on June 4 to 12 years in prison for his role in a massive insider-trading scheme that carried on for nearly two decades and was made possible in large part by his position as an associate with a series of Am Law 100 firms. According to Bloomberg, his prison term is the longest ever imposed for insider trading, exceeding the 11-year sentence given last year to Galleon Group co-founder Raj Rajaratnam. Prosecutors say the scheme netted a combined total of more than $37 million in illicit gains for the 51-year-old Kluger—who, based on federal sentencing guidelines, faced between 11 and 14 years in prison—and his two collaborators: former stock trader Garrett Bauer and mortgage broker Kenneth Robinson. In handing down what she acknowledged was a harsh sentence, U.S. District Court Judge Katharine Hayden in Newark, N.J., said that Kluger's crime warranted such a stiff penalty because "it allows greedy, arrogant people to make money off others." In a statement to the court, Kluger expressed remorse for his actions. He said he wanted the court to know "how terribly, terribly sorry I am." He also expressed a desire to make reparations to some of those he wronged along the way. "I will do anything I can to try and regain a modicum of the trust that I destroyed [with] so many people and so many institutions," he said.

The sentencing comes a little more than one year after prosecutors accused Kluger in a federal complaint of participating in the insider-trading ring. Kluger pleaded guilty to all four counts against him, including conspiracy to commit securities fraud, securities fraud, conspiracy to commit money laundering, and obstruction of justice (NYLJ, Dec. 16, 2011). The three-man operation kicked off in 1994, according to Robinson's court testimony, when Kluger was a summer associate at Cravath, Swaine & Moore, and continued as he moved on to associate positions at Skadden, Arps, Slate, Meagher & Flom; Fried, Frank, Harris, Shriver & Jacobson; and, finally, Wilson Sonsini Goodrich & Rosati. Kluger stole confidential information related to corporate transactional work being handled by his employer at each stop, then passed details of pending corporate mergers to Robinson, the scheme's middleman. Robinson would then pass the details on to Bauer, who would then use the inside information to purchase shares for all three men, according to Robinson's testimony.

Across the span of the roughly 17-year scheme, Kluger and his cohorts traded ahead of more than 30 separate transactions, prosecutors say. In December, as part of a settlement agreement with the U.S. Securities and Exchange Commission, the three men agreed to repay their illegal profits from the conspiracy. Prosecutors have said that Bauer took the "lion's share of the profits," which is why the former trader was required earlier this year to forfeit roughly $31.6 million. For his part, Kluger agreed to forfeit $516,000. Robinson will pay $845,000. In court on June 4, Kluger's attorney, Alan Zegas of Chatham, N.J., argued that his client was insulated from Bauer during the course of the conspiracy and was misled by his co-conspirators as to the amount of stock being purchased as a result of the inside information he was passing along. According to Zegas, Kluger claims the three men began the scheme with an agreement to split all proceeds equally, and that Kluger would have ceased providing the inside information had he known Bauer planned on purchasing a higher volume of stock. Assistant U.S. Attorney Judith Germano made it clear during the sentencing that the government didn't accept Kluger's claims of what she called a "loosey-goosey agreement" between the trio to split their gains three ways. Zegas used his client's supposed ignorance about the scope of the scheme to argue for a lighter sentence, even going so far as to ask that Hayden delay sentencing until a hearing could be scheduled to weigh additional evidence he said would establish his client's ignorance about the scope of Bauer's trading activities. The judge refused that request. After being sentenced, Kluger told a group of reporters that he had been forthcoming with the government since the time of his arrest and reiterated his belief that further discovery would reveal that his cohorts deliberately withheld information from him throughout the scheme. "A hearing with Ken Robinson on the stand…he would have admitted to doing things on each deal actively to mislead me," Kluger said. Zegas told reporters that he is considering appealing the sentence.

Recorded Conversations - The case came together after Robinson agreed to cooperate with prosecutors and recorded several conversations with Kluger whose contents were contained in a criminal complaint filed against the former lawyer. Robinson pleaded guilty last April to one count of conspiracy to commit securities fraud and two counts of securities fraud. Like Kluger, Bauer pleaded guilty in December to all four counts against him. Among the more interesting details of the case is the origin of obstruction of justice charges against Kluger and Bauer. In Kluger's case, he destroyed a computer and an iPhone upon learning that authorities had searched Robinson's home, according to court documents, while also instructing Robinson to destroy a prepaid cellphone that he had used to communicate with Kluger and Bauer. Meanwhile, Bauer's obstruction of justice charge came about after he broke his own prepaid cellphone into two pieces and tossed them in separate trash cans at a Manhattan McDonald's. Bauer was sentenced to nine years in prison on June 4, while Robinson got 27 months. Robinson received a shorter sentence due to his cooperation with authorities. (Since his arrest, Bauer has been telling his story to groups of people at such places as business schools and law schools, encouraging others not to follow his criminal path, Bloomberg reports.) For her part, Germano asserted that Kluger was the scheme's mastermind and that none of the illegal trading would have been possible without the insider information he stole from his employers. She also frequently returned to the fact that the scheme began while Kluger was just a summer associate—pointing out that he had already headed down a criminal path before he even became a full-time lawyer. "He was an attorney who had a duty of trust," she said, "a duty to uphold the confidence" of his clients and employers. @|Tom Huddleston Jr., a reporter for The American Lawyer, an affiliate, can be contacted at thuddleston@alm.com.

Selective Sex Abuse Justice

The selective justice of Charles Hynes

The New York Daily News by Arnold Kriss - OPINION - June 6, 2012

His only duty should be to the victims

Brooklyn District Attorney Charles Hynes’ justification for not disclosing the names of sex abuse defendants in the Orthodox Jewish community as a way to protect victims and witnesses — a revelation of which much has been made lately in the press — is unpersuasive. “I haven’t seen this kind of intimidation in organized crime cases or police corruption,” Hynes told the Daily News last week. “Nobody gives a damn about victims (in the Orthodox community). All they care about is protecting the abusers.” Prosecuting sex abuse cases is always tough — and the closed-off world of Orthodox Judaism does pose its own challenges. But that is no excuse for the kind of lax (some might even say nonexistent) prosecution that Hynes oversaw for some two decades — at least until becoming more aggressive in recent years. And then there is Hynes’ nondisclosure policy, which remains unchanged despite calls for openness. Hynes has been steadfast in his position that disclosing the names of arrested sexual predators from this insular community will discourage future victims from coming forward. What makes Hynes’ position indefensible is that, while he has long protected Orthodox Jews accused of sex crimes, he has no hesitation releasing defendants’ names in similar cases when it comes to other groups.

For instance, on Jan. 26, 2011, Hynes announced the indictment of two men (neither an Orthodox Jew) who forced teenage girls into prostitution. One of the victims filed a report that resulted in the arrest of two named defendants. A year later, in another press release, Hynes’ office announced the indictments of 43 gang members, disclosing the names of the gang leaders charged and describing the crimes perpetrated against the unnamed victims. Any of the violent gang-affiliated defendants who were charged could have easily figured out the identity of the victims and witnesses by simply reading that press release. These in-the-open prosecutions demonstrate the imbalance of Hynes’ practice of disclosing only the identities of certain charged defendants who live in certain communities — while keeping the public in the dark about other defendants, perhaps those who come from powerful voting blocs whose support Hynes needs. After all, gang members and pimps do not simply “shun” a victim who reports a crime, as is supposedly done by the Orthodox. Instead, they often intimidate, threaten, coerce and, in some cases, kill, witnesses and victims. Even without publicly disclosing an Orthodox defendant’s name to protect a victim, the extremely personal nature of a sex abuse allegation usually means that the victim’s and witness’ identity is discernible to an alleged sex abuse defendant and his lawyer. All they have to do is to read the factual portion of a criminal complaint and review other material furnished by the prosecutor. And while the criminal case is pending for months, nothing stops a criminal defendant from disclosing that an informant lives among them, thus opening the floodgates of intimidation. In other words, Hynes’ “discretion” does nothing for the very victim he purports to serve. It just garners him favor from a group that does not like attention drawn to itself. But that’s not how our criminal justice system should work; the rule of law requires equal treatment for all individuals. A district attorney who represents the people of Brooklyn compromises the mission of his office by serving one community’s self-interest for secrecy. This unequal treatment is unacceptable no matter how you justify it. Kriss, a former Brooklyn assistant district attorney who challenged Hynes in 2005, has also served as a Police Department deputy commissioner for trials. He is currently in private practice in Manhattan.

The New York Daily News by Arnold Kriss - OPINION - June 6, 2012

His only duty should be to the victims

Brooklyn District Attorney Charles Hynes’ justification for not disclosing the names of sex abuse defendants in the Orthodox Jewish community as a way to protect victims and witnesses — a revelation of which much has been made lately in the press — is unpersuasive. “I haven’t seen this kind of intimidation in organized crime cases or police corruption,” Hynes told the Daily News last week. “Nobody gives a damn about victims (in the Orthodox community). All they care about is protecting the abusers.” Prosecuting sex abuse cases is always tough — and the closed-off world of Orthodox Judaism does pose its own challenges. But that is no excuse for the kind of lax (some might even say nonexistent) prosecution that Hynes oversaw for some two decades — at least until becoming more aggressive in recent years. And then there is Hynes’ nondisclosure policy, which remains unchanged despite calls for openness. Hynes has been steadfast in his position that disclosing the names of arrested sexual predators from this insular community will discourage future victims from coming forward. What makes Hynes’ position indefensible is that, while he has long protected Orthodox Jews accused of sex crimes, he has no hesitation releasing defendants’ names in similar cases when it comes to other groups.

For instance, on Jan. 26, 2011, Hynes announced the indictment of two men (neither an Orthodox Jew) who forced teenage girls into prostitution. One of the victims filed a report that resulted in the arrest of two named defendants. A year later, in another press release, Hynes’ office announced the indictments of 43 gang members, disclosing the names of the gang leaders charged and describing the crimes perpetrated against the unnamed victims. Any of the violent gang-affiliated defendants who were charged could have easily figured out the identity of the victims and witnesses by simply reading that press release. These in-the-open prosecutions demonstrate the imbalance of Hynes’ practice of disclosing only the identities of certain charged defendants who live in certain communities — while keeping the public in the dark about other defendants, perhaps those who come from powerful voting blocs whose support Hynes needs. After all, gang members and pimps do not simply “shun” a victim who reports a crime, as is supposedly done by the Orthodox. Instead, they often intimidate, threaten, coerce and, in some cases, kill, witnesses and victims. Even without publicly disclosing an Orthodox defendant’s name to protect a victim, the extremely personal nature of a sex abuse allegation usually means that the victim’s and witness’ identity is discernible to an alleged sex abuse defendant and his lawyer. All they have to do is to read the factual portion of a criminal complaint and review other material furnished by the prosecutor. And while the criminal case is pending for months, nothing stops a criminal defendant from disclosing that an informant lives among them, thus opening the floodgates of intimidation. In other words, Hynes’ “discretion” does nothing for the very victim he purports to serve. It just garners him favor from a group that does not like attention drawn to itself. But that’s not how our criminal justice system should work; the rule of law requires equal treatment for all individuals. A district attorney who represents the people of Brooklyn compromises the mission of his office by serving one community’s self-interest for secrecy. This unequal treatment is unacceptable no matter how you justify it. Kriss, a former Brooklyn assistant district attorney who challenged Hynes in 2005, has also served as a Police Department deputy commissioner for trials. He is currently in private practice in Manhattan.

Another Effort to Simplify Corrupt Structure of Courts

State Bar Joins Call for Constitutional Amendment to Simplify Structure of Courts

The New York Law Journal by John Caher - May 30, 2012

ALBANY, NY - In the latest multi-decade effort to reconfigure New York's archaic court structure, the New York State Bar Association is joining about 50 legal organizations, business leaders, good government groups and citizens calling for a constitutional amendment. The proposed amendment would consolidate the state's unwieldy court system into two tiers. It would merge county court, family court, surrogate's court and the Court of Claims into a new Supreme Court, while creating a new district court comprised of the district courts on Long Island and city courts. The measure would not affect the town and village courts. A "Coalition for Court Simplification" has been established by the Fund for Modern Courts and on Tuesday, State Bar President Vincent Doyle Jr. of Connors & Vilardo in Buffalo announced that the bar will join the coalition. Other members include the African Services Committee, the Business Council of New York, the Lawyers Committee Against Domestic Violence, the League of Women Voters, the New York City Bar Association, New York County Lawyers' Association and St. Luke's-Roosevelt Crime Victims Treatment Center. "The existing court structure no longer adequately serves the citizens of New York," said Doyle. Now, a contested divorce with child custody and domestic violence issues could involve three different courts: Supreme Court to address the marital dissolution and financial issues; Family Court to deal with child custody and county court to handle domestic violence and order of protection issues. "The labyrinth of overlapping jurisdictions of multiple courts creates unnecessary financial burdens and delays for millions of litigants. It needs to be changed," Doyle said. The coalition is co-chaired by former state bar president, Stephen Younger of Patterson, Bellknap, Webb & Tyler, and Fern Schair of Fordham Law School.

Advocates, many lawmakers and chief judges dating back at least to the 1970s have been struggling to re-cast a court system created at a time when Brooklyn was a cow pasture. According to the coalition, revamping the court system would save taxpayers $121 million annually while saving litigants $433 million a year in attorney fees. Milton Williams, chairman of Modern Courts, said the organization is attempting to keep the issue alive and increase momentum. "It is a massive issue with so many different angles and components that it is hard to have everyone on the same page at the same time," said Williams, of Vladeck, Waldman, Elias & Englehard. "We are able to accomplish some goals immediately and others where we have to keep chipping away. This is one we just keep chipping away at." Heather Briccetti, president and CEO of the Business Council of New York State, said her organization joined the coalition because it views court simplification partially as an economic/ government efficiency issue. "As part of our reform agenda, we support government consolidation, and this is an obvious one," said Briccetti, an attorney. "A secondary reason is we represent employers and when an employee is going through a difficult time, like a divorce, we think it would be better for the employee and employer if they only had to go to one court versus maybe three. Also, our members are sometimes involved in lawsuits and we think having a simplified court system will save them money and time." Although there is no court consolidation bill now before the Legislature, Briccetti said she believes the reform effort is closer to success than it has been as a result of the broad scope of interests reflected in the coalition. "There is a real push to build a strong coalition," Briccetti said. "We've got the state and city bar associations on board and lot of diverse interests. I think it has a better shot now than it has in the past." Mark Mahoney, spokesman for the state bar, said that although there is no pending legislation to amend the state Constitution, the organization hopes to generate interest this session. Several lawmakers have repeatedly stated their support for court consolidation. Amending the Constitution requires action by successive legislatures followed by a public referendum. Since this is the last year of a session, if the currently sitting Legislature passed a measure this year and the body elected in November passes it next year, it could appear on the ballot as early as 2013. @|John Caher can be reached at jcaher@alm.com

The New York Law Journal by John Caher - May 30, 2012

ALBANY, NY - In the latest multi-decade effort to reconfigure New York's archaic court structure, the New York State Bar Association is joining about 50 legal organizations, business leaders, good government groups and citizens calling for a constitutional amendment. The proposed amendment would consolidate the state's unwieldy court system into two tiers. It would merge county court, family court, surrogate's court and the Court of Claims into a new Supreme Court, while creating a new district court comprised of the district courts on Long Island and city courts. The measure would not affect the town and village courts. A "Coalition for Court Simplification" has been established by the Fund for Modern Courts and on Tuesday, State Bar President Vincent Doyle Jr. of Connors & Vilardo in Buffalo announced that the bar will join the coalition. Other members include the African Services Committee, the Business Council of New York, the Lawyers Committee Against Domestic Violence, the League of Women Voters, the New York City Bar Association, New York County Lawyers' Association and St. Luke's-Roosevelt Crime Victims Treatment Center. "The existing court structure no longer adequately serves the citizens of New York," said Doyle. Now, a contested divorce with child custody and domestic violence issues could involve three different courts: Supreme Court to address the marital dissolution and financial issues; Family Court to deal with child custody and county court to handle domestic violence and order of protection issues. "The labyrinth of overlapping jurisdictions of multiple courts creates unnecessary financial burdens and delays for millions of litigants. It needs to be changed," Doyle said. The coalition is co-chaired by former state bar president, Stephen Younger of Patterson, Bellknap, Webb & Tyler, and Fern Schair of Fordham Law School.

Advocates, many lawmakers and chief judges dating back at least to the 1970s have been struggling to re-cast a court system created at a time when Brooklyn was a cow pasture. According to the coalition, revamping the court system would save taxpayers $121 million annually while saving litigants $433 million a year in attorney fees. Milton Williams, chairman of Modern Courts, said the organization is attempting to keep the issue alive and increase momentum. "It is a massive issue with so many different angles and components that it is hard to have everyone on the same page at the same time," said Williams, of Vladeck, Waldman, Elias & Englehard. "We are able to accomplish some goals immediately and others where we have to keep chipping away. This is one we just keep chipping away at." Heather Briccetti, president and CEO of the Business Council of New York State, said her organization joined the coalition because it views court simplification partially as an economic/ government efficiency issue. "As part of our reform agenda, we support government consolidation, and this is an obvious one," said Briccetti, an attorney. "A secondary reason is we represent employers and when an employee is going through a difficult time, like a divorce, we think it would be better for the employee and employer if they only had to go to one court versus maybe three. Also, our members are sometimes involved in lawsuits and we think having a simplified court system will save them money and time." Although there is no court consolidation bill now before the Legislature, Briccetti said she believes the reform effort is closer to success than it has been as a result of the broad scope of interests reflected in the coalition. "There is a real push to build a strong coalition," Briccetti said. "We've got the state and city bar associations on board and lot of diverse interests. I think it has a better shot now than it has in the past." Mark Mahoney, spokesman for the state bar, said that although there is no pending legislation to amend the state Constitution, the organization hopes to generate interest this session. Several lawmakers have repeatedly stated their support for court consolidation. Amending the Constitution requires action by successive legislatures followed by a public referendum. Since this is the last year of a session, if the currently sitting Legislature passed a measure this year and the body elected in November passes it next year, it could appear on the ballot as early as 2013. @|John Caher can be reached at jcaher@alm.com

Panel Suspends Attorney for Trying to Deceive Court

Panel Suspends Attorney for Trying to Deceive Court

The New York Law Journal by Brendan Pierson - June 6, 2012

Manhattan attorney Armand Rosenberg has been suspended for one year for trying to deceive a court in the course of a real estate dispute, confirming the recommendation of the Departmental Disciplinary Committee for the First Judicial Department. The charges against him arise from a case in which he represented Peter Costalas, a member of a family partnership along with his brothers James and John that owned five buildings and 12 restaurants. According to the First Department's ruling yesterday, Peter "diverted millions of dollars in partnership funds and mortgaged buildings" by using forged signatures "to cover losses incurred in connection with his personal trading in stock options." His brothers sued him, and he reached a settlement that included giving them his share in the partnership. The brothers later sold their share to Vivia Amalfitano, James' daughter. In 2001, Peter sued her and her husband in Manhattan state court, alleging his partnership had been transferred away fraudulently and he was still a partner. That suit was dismissed, and the Amalfitanos sued Peter in federal court for allegedly deceiving the state court during the litigation by providing false information. Southern District Judge Naomi Reice Buchwald agreed that Armand had engaged in a "persistent pattern of unethical behavior" and assessed treble damages of $268,245 against him (NYLJ, Feb. 17, 2009). She found that Rosenberg filed the state lawsuit on behalf of Peter "despite knowing it was entirely baseless" because the lawyer had represented Peter in the earlier settlement and knew he had given up his partnership. The panel consisted of Justices Richard Andrias, David Saxe, John Sweeny, James Catterson and Rolando Acosta. Rosenberg is represented by Richard Maltz.

Matter of Rosenberg, M-3654

Disciplinary Proceeding, Appellate Division, First Department - M-3654

Cite as: Matter of Rosenberg, M-3654, NYLJ 1202557354417, at *1 (App. Div. 1st, Decided June 5, 2012) - Before: Andrias, J.P., Saxe, Sweeny, Catterson and Acosta, JJ. - Decided: June 5, 2012

Jorge Dopico, Chief Counsel, Departmental Disciplinary Committee, New York (Scott D. Smith, of counsel), for petitioner. Richard M. Maltz, for respondent.

Disciplinary proceedings instituted by the Departmental Disciplinary Committee for the First Judicial Department. Respondent, Armand J. Rosenberg, was admitted to the Bar of the State of New York at a Term of the Appellate Division of the Supreme Court for the First Judicial Department on April 2, 1951.

PER CURIAM - Respondent Armand J. Rosenberg was admitted to the practice of law in the State of New York by the First Judicial Department on April 2, 1951. At all time relevant to this proceeding, respondent's registered office was within the First Department. By order dated October 13, 2010 this Court granted the Departmental Disciplinary Committee's petition for an order giving collateral estoppel effect to an April 2006 decision by the U.S. District Court for the Southern District of New York in the case of Amalfitano v. Rosenberg - (428 F Supp 2d 196 [SDNY 2006], affd 572 F3d 91 [2d Cir 2009]), in which respondent was found to have engaged in fraudulent conduct, in violation of New York Judiciary Law §487, and imposed treble damages in the amount of $268,245.54. Our order further found that respondent's conduct violated DR 1-102(A)(4) (conduct involving dishonesty, fraud, deceit or misrepresentation), DR 1-102(A)(5) (conduct prejudicial to the administration of justice), DR 1-102(A)(7) (conduct that adversely reflects on respondent's fitness as a lawyer), DR 7-102(A)(4) (knowingly using perjured testimony), and DR 7-102(A)(5) (knowingly making a false statement of law or fact), and referred the matter to a Hearing Panel for a sanction hearing. The Committee is now seeking an order confirming the Hearing Panel's findings of fact, conclusions of law and recommendation of a one-year suspension. This matter stems from respondent's representation of Peter Costalas, who, along with his two brothers, James and John, were members of a family partnership that owned five buildings and twelve restaurants. Peter diverted millions of dollars in partnership finds and mortgaged buildings by use of forged signatures in order to cover losses incurred in connection with his personal trading in stock options. As a result, James and John commenced an action against Peter and his brokers. In August 1993, respondent negotiated an agreement on Peter's behalf in which Peter, among other things, assigned and transferred his interest in the partnership to John, and in return, was dismissed as a defendant in the litigation. Thereafter, Vivia Amalfitano, James' daughter, purchased the partnership's remaining building and restaurant from John and James. In May 2001, respondent commenced an action in New York County, Supreme Court, naming Vivia and her husband, Gerard Amalfitano, Esq., as defendants, alleging that they defrauded John and James into conveying the partnership's remaining property and business, and that Peter was still a partner. The action was eventually dismissed during trial. Respondent then unsuccessfully appealed the trial court's order denying his motion to vacate (see Costalas v. Amalfitano - 23 AD3d 303 [2005]). In March 2004, the Amalfitanos commenced the above-mentioned federal action against respondent alleging that respondent's commencement and prosecution of the state court action against them constituted a violation of Judiciary Law §487. We agree with the recommendation of the Panel that respondent should be suspended for one year ( Matter of Berglas, 16 AD3d 1 [2005] [one-year suspension, where respondent submitted three filings to the INS containing false information regarding his clients' addresses]; Matter of Nash, 166 AD2d 84 [1991] [one-year suspension, where respondent falsely notarized documents and submitted false verifications and affidavits in a matrimonial action]). Accordingly, the Committee's motion to confirm the Hearing Panel's determination should be granted and respondent suspended from the practice of law for one year, and until further order of this Court. All concur.

The New York Law Journal by Brendan Pierson - June 6, 2012

Manhattan attorney Armand Rosenberg has been suspended for one year for trying to deceive a court in the course of a real estate dispute, confirming the recommendation of the Departmental Disciplinary Committee for the First Judicial Department. The charges against him arise from a case in which he represented Peter Costalas, a member of a family partnership along with his brothers James and John that owned five buildings and 12 restaurants. According to the First Department's ruling yesterday, Peter "diverted millions of dollars in partnership funds and mortgaged buildings" by using forged signatures "to cover losses incurred in connection with his personal trading in stock options." His brothers sued him, and he reached a settlement that included giving them his share in the partnership. The brothers later sold their share to Vivia Amalfitano, James' daughter. In 2001, Peter sued her and her husband in Manhattan state court, alleging his partnership had been transferred away fraudulently and he was still a partner. That suit was dismissed, and the Amalfitanos sued Peter in federal court for allegedly deceiving the state court during the litigation by providing false information. Southern District Judge Naomi Reice Buchwald agreed that Armand had engaged in a "persistent pattern of unethical behavior" and assessed treble damages of $268,245 against him (NYLJ, Feb. 17, 2009). She found that Rosenberg filed the state lawsuit on behalf of Peter "despite knowing it was entirely baseless" because the lawyer had represented Peter in the earlier settlement and knew he had given up his partnership. The panel consisted of Justices Richard Andrias, David Saxe, John Sweeny, James Catterson and Rolando Acosta. Rosenberg is represented by Richard Maltz.

Matter of Rosenberg, M-3654

Disciplinary Proceeding, Appellate Division, First Department - M-3654

Cite as: Matter of Rosenberg, M-3654, NYLJ 1202557354417, at *1 (App. Div. 1st, Decided June 5, 2012) - Before: Andrias, J.P., Saxe, Sweeny, Catterson and Acosta, JJ. - Decided: June 5, 2012

Jorge Dopico, Chief Counsel, Departmental Disciplinary Committee, New York (Scott D. Smith, of counsel), for petitioner. Richard M. Maltz, for respondent.

Disciplinary proceedings instituted by the Departmental Disciplinary Committee for the First Judicial Department. Respondent, Armand J. Rosenberg, was admitted to the Bar of the State of New York at a Term of the Appellate Division of the Supreme Court for the First Judicial Department on April 2, 1951.

PER CURIAM - Respondent Armand J. Rosenberg was admitted to the practice of law in the State of New York by the First Judicial Department on April 2, 1951. At all time relevant to this proceeding, respondent's registered office was within the First Department. By order dated October 13, 2010 this Court granted the Departmental Disciplinary Committee's petition for an order giving collateral estoppel effect to an April 2006 decision by the U.S. District Court for the Southern District of New York in the case of Amalfitano v. Rosenberg - (428 F Supp 2d 196 [SDNY 2006], affd 572 F3d 91 [2d Cir 2009]), in which respondent was found to have engaged in fraudulent conduct, in violation of New York Judiciary Law §487, and imposed treble damages in the amount of $268,245.54. Our order further found that respondent's conduct violated DR 1-102(A)(4) (conduct involving dishonesty, fraud, deceit or misrepresentation), DR 1-102(A)(5) (conduct prejudicial to the administration of justice), DR 1-102(A)(7) (conduct that adversely reflects on respondent's fitness as a lawyer), DR 7-102(A)(4) (knowingly using perjured testimony), and DR 7-102(A)(5) (knowingly making a false statement of law or fact), and referred the matter to a Hearing Panel for a sanction hearing. The Committee is now seeking an order confirming the Hearing Panel's findings of fact, conclusions of law and recommendation of a one-year suspension. This matter stems from respondent's representation of Peter Costalas, who, along with his two brothers, James and John, were members of a family partnership that owned five buildings and twelve restaurants. Peter diverted millions of dollars in partnership finds and mortgaged buildings by use of forged signatures in order to cover losses incurred in connection with his personal trading in stock options. As a result, James and John commenced an action against Peter and his brokers. In August 1993, respondent negotiated an agreement on Peter's behalf in which Peter, among other things, assigned and transferred his interest in the partnership to John, and in return, was dismissed as a defendant in the litigation. Thereafter, Vivia Amalfitano, James' daughter, purchased the partnership's remaining building and restaurant from John and James. In May 2001, respondent commenced an action in New York County, Supreme Court, naming Vivia and her husband, Gerard Amalfitano, Esq., as defendants, alleging that they defrauded John and James into conveying the partnership's remaining property and business, and that Peter was still a partner. The action was eventually dismissed during trial. Respondent then unsuccessfully appealed the trial court's order denying his motion to vacate (see Costalas v. Amalfitano - 23 AD3d 303 [2005]). In March 2004, the Amalfitanos commenced the above-mentioned federal action against respondent alleging that respondent's commencement and prosecution of the state court action against them constituted a violation of Judiciary Law §487. We agree with the recommendation of the Panel that respondent should be suspended for one year ( Matter of Berglas, 16 AD3d 1 [2005] [one-year suspension, where respondent submitted three filings to the INS containing false information regarding his clients' addresses]; Matter of Nash, 166 AD2d 84 [1991] [one-year suspension, where respondent falsely notarized documents and submitted false verifications and affidavits in a matrimonial action]). Accordingly, the Committee's motion to confirm the Hearing Panel's determination should be granted and respondent suspended from the practice of law for one year, and until further order of this Court. All concur.

'Highly Qualified' List For Top Judicial Post Grows

10 Justices Found Highly Qualified for P.J. Post

The New York Law Journal by John Caher - June 6, 2012

Two more judges were found to be highly qualified for the position of presiding justice of the Appellate Division, Second Department, bringing the number of judges in the running to at least 10, according to sources close to the process. Appellate Division, Second Department Justices Sheri Roman and Reinaldo Rivera were among the names of highly qualified judges forwarded by a screening panel to Governor Andrew Cuomo, who will name a successor to A. Gail Prudenti, who became chief administrative judge in December. The Law Journal has reported the names of the other judges on the list: Acting Presiding Justice William Mastro of the Second Department and five of his colleagues: Leonard Austin, Cheryl Chambers, Randall Eng, Robert Miller, and Peter Skelos. At least two First Department justices, Angela Mazzarelli and David Friedman, also were recommended, sources said (NYLJ, May 25). The governor expects to make an appointment this month, a source said. The governor must choose from among the candidates found highly qualified by 13-member screening panels in each department. Douglas Dunham of Skadden, Arps, Slate, Meagher & Flom chairs the Second Department screening panel.

Related Background Story:

At Least 8 Found 'Highly Qualified' for Presiding Justice, Sources Say

The New York Law Journal by John Caher - May 25, 2012

At least eight judges are apparently in the running for presiding justice of the Appellate Division, Second Department, as a screening panel has forwarded to Governor Andrew Cuomo the names of judges it found "highly qualified" to succeed A. Gail Prudenti as leader of the Brooklyn appeals court. Several sources close to the process said the screening panel has advanced Acting Presiding Justice William Mastro of the Second Department and five of his colleagues: Leonard Austin, Cheryl Chambers, Randall Eng, Robert Miller and Peter Skelos. In addition, at least two First Department justices, Angela Mazzarelli and David Friedman, were recommended, sources said. The governor's counsel's office has concluded interviewing candidates with an eye toward making an appointment in June, a source said. The Second Department has been without a permanent presiding justice since last fall, when Prudenti became chief administrative judge and Mastro, as senior associate, automatically took over as acting presiding justice. The Brooklyn-based court, which is the busiest appellate court in the state, is the only one of the four departments that continues to operate with an acting presiding justice. In early April, Cuomo appointed Karen Peters as presiding justice of the Third Department to replace Acting Presiding Justice Thomas Mercure (NYLJ, April 6). Meanwhile, all four Appellate Division departments remain shorthanded, especially the Fourth Department in Rochester that is down 25 percent of its judges with three of 12 spots vacant. The First and Second departments are each down three of their 20 and 22 judges, respectively, and the Third is operating with one short of its full contingent of 12. Appellate Division justices are selected by the governor from the ranks of elected Supreme Court justices; acting Supreme Court justices are not eligible. The governor must choose from among the candidates found highly qualified by 13-member screening panels in each department. Douglas Dunham of Skadden, Arps, Slate, Meagher & Flom chairs the Second Department screening panel. John Caher can be contacted at jcaher@alm.com

The New York Law Journal by John Caher - June 6, 2012

Two more judges were found to be highly qualified for the position of presiding justice of the Appellate Division, Second Department, bringing the number of judges in the running to at least 10, according to sources close to the process. Appellate Division, Second Department Justices Sheri Roman and Reinaldo Rivera were among the names of highly qualified judges forwarded by a screening panel to Governor Andrew Cuomo, who will name a successor to A. Gail Prudenti, who became chief administrative judge in December. The Law Journal has reported the names of the other judges on the list: Acting Presiding Justice William Mastro of the Second Department and five of his colleagues: Leonard Austin, Cheryl Chambers, Randall Eng, Robert Miller, and Peter Skelos. At least two First Department justices, Angela Mazzarelli and David Friedman, also were recommended, sources said (NYLJ, May 25). The governor expects to make an appointment this month, a source said. The governor must choose from among the candidates found highly qualified by 13-member screening panels in each department. Douglas Dunham of Skadden, Arps, Slate, Meagher & Flom chairs the Second Department screening panel.

Related Background Story:

At Least 8 Found 'Highly Qualified' for Presiding Justice, Sources Say

The New York Law Journal by John Caher - May 25, 2012

At least eight judges are apparently in the running for presiding justice of the Appellate Division, Second Department, as a screening panel has forwarded to Governor Andrew Cuomo the names of judges it found "highly qualified" to succeed A. Gail Prudenti as leader of the Brooklyn appeals court. Several sources close to the process said the screening panel has advanced Acting Presiding Justice William Mastro of the Second Department and five of his colleagues: Leonard Austin, Cheryl Chambers, Randall Eng, Robert Miller and Peter Skelos. In addition, at least two First Department justices, Angela Mazzarelli and David Friedman, were recommended, sources said. The governor's counsel's office has concluded interviewing candidates with an eye toward making an appointment in June, a source said. The Second Department has been without a permanent presiding justice since last fall, when Prudenti became chief administrative judge and Mastro, as senior associate, automatically took over as acting presiding justice. The Brooklyn-based court, which is the busiest appellate court in the state, is the only one of the four departments that continues to operate with an acting presiding justice. In early April, Cuomo appointed Karen Peters as presiding justice of the Third Department to replace Acting Presiding Justice Thomas Mercure (NYLJ, April 6). Meanwhile, all four Appellate Division departments remain shorthanded, especially the Fourth Department in Rochester that is down 25 percent of its judges with three of 12 spots vacant. The First and Second departments are each down three of their 20 and 22 judges, respectively, and the Third is operating with one short of its full contingent of 12. Appellate Division justices are selected by the governor from the ranks of elected Supreme Court justices; acting Supreme Court justices are not eligible. The governor must choose from among the candidates found highly qualified by 13-member screening panels in each department. Douglas Dunham of Skadden, Arps, Slate, Meagher & Flom chairs the Second Department screening panel. John Caher can be contacted at jcaher@alm.com

Tuesday, June 5, 2012

Lawyer-Prosecutor Takes Swing At Cop During Traffic Stop

Brooklyn Asst. DA in highway stop and ‘pop’

The New York Post by Ikimulisa Livingston, Christina Carrega and Jose Martinez - June 5, 2012

He objected to getting pulled over, so a Brooklyn prosecutor literally fought the law — taking a swing at a Queens cop, officials said yesterday. In the latest in a series of black eyes for the office of District Attorney Charles Hynes, assistant DA Yaser Othman was arrested early Saturday night after he took a wild swing at Sgt. Benjamin Benson when the cop stopped him for swerving through traffic on the Whitestone Expressway, officials said. The 41-year-old prosecutor, who was hired by the Brooklyn DA in 2010, was suspended without pay after his arrest, during which officers allegedly also found a joint in a cigarette pack in his car. He was charged with marijuana possession, resisting arrest, reckless driving and attempted assault. A team of Queens Narcotics cops in an unmarked van reported seeing Othman swerve his white 2002 Mitsubishi Galant in and out of traffic without using turn signals, police said. Othman allegedly cut the van off and was finally pulled over near Astoria and Ditmars boulevards around 6:20 p.m. He refused to get out and had to be removed from his car by Sgt. Benson, Queens prosecutors said. That’s when he swung at Benson with a right haymaker that missed while trying to avoid being handcuffed, prosecutors allege. Police said they recovered the joint during a search of the car. A source in the Brooklyn DA’s Office said Othman hadn’t been in any trouble in his two years on the job, adding, “He hasn’t been around long enough to have developed any type of reputation.” Near his Queens home yesterday, Othman, a father of two, insisted he’ll be cleared. “I am innocent of what they say that I did. The truth is going to come out,” he said. Othman, who is assigned to a unit that prosecutes low-level offenders in neighborhoods such as Canarsie and East New York, denied the joint was his, saying: “I don’t know anything about a marijuana cigarette. I can’t say if they planted it.” Othman appealed to witnesses who may have encountered his run-in with the law. He was freed without bail after being arraigned on Sunday. His arrest comes on the heels of increased pressure on his boss over Hynes’ handling of sexual predators in the ultra-Orthodox Jewish community. It also follows the abrupt resignation last month of a top sex-crimes prosecutor who allegedly failed to disclose that an Orthodox woman had recanted her claims of being beaten, raped and pimped out by four men. Othman’s allegedly wild ride is another embarrassment for Brooklyn prosecutors, who in 2010 had a murder conviction tossed for not disclosing crucial information to the defense in the case of a man who spent 16 years in prison. ikimulisa.livingston@nypost.com

The New York Post by Ikimulisa Livingston, Christina Carrega and Jose Martinez - June 5, 2012

He objected to getting pulled over, so a Brooklyn prosecutor literally fought the law — taking a swing at a Queens cop, officials said yesterday. In the latest in a series of black eyes for the office of District Attorney Charles Hynes, assistant DA Yaser Othman was arrested early Saturday night after he took a wild swing at Sgt. Benjamin Benson when the cop stopped him for swerving through traffic on the Whitestone Expressway, officials said. The 41-year-old prosecutor, who was hired by the Brooklyn DA in 2010, was suspended without pay after his arrest, during which officers allegedly also found a joint in a cigarette pack in his car. He was charged with marijuana possession, resisting arrest, reckless driving and attempted assault. A team of Queens Narcotics cops in an unmarked van reported seeing Othman swerve his white 2002 Mitsubishi Galant in and out of traffic without using turn signals, police said. Othman allegedly cut the van off and was finally pulled over near Astoria and Ditmars boulevards around 6:20 p.m. He refused to get out and had to be removed from his car by Sgt. Benson, Queens prosecutors said. That’s when he swung at Benson with a right haymaker that missed while trying to avoid being handcuffed, prosecutors allege. Police said they recovered the joint during a search of the car. A source in the Brooklyn DA’s Office said Othman hadn’t been in any trouble in his two years on the job, adding, “He hasn’t been around long enough to have developed any type of reputation.” Near his Queens home yesterday, Othman, a father of two, insisted he’ll be cleared. “I am innocent of what they say that I did. The truth is going to come out,” he said. Othman, who is assigned to a unit that prosecutes low-level offenders in neighborhoods such as Canarsie and East New York, denied the joint was his, saying: “I don’t know anything about a marijuana cigarette. I can’t say if they planted it.” Othman appealed to witnesses who may have encountered his run-in with the law. He was freed without bail after being arraigned on Sunday. His arrest comes on the heels of increased pressure on his boss over Hynes’ handling of sexual predators in the ultra-Orthodox Jewish community. It also follows the abrupt resignation last month of a top sex-crimes prosecutor who allegedly failed to disclose that an Orthodox woman had recanted her claims of being beaten, raped and pimped out by four men. Othman’s allegedly wild ride is another embarrassment for Brooklyn prosecutors, who in 2010 had a murder conviction tossed for not disclosing crucial information to the defense in the case of a man who spent 16 years in prison. ikimulisa.livingston@nypost.com

Lawyer-Prosecutors Held Boozy Bash in Evidence Room

Bronx prosecutors held boozy bash in main ticket-fixing evidence room: sources

The New York Post by Kirstan Conley and Jeane MacIntosh - June 4, 2012

A rowdy group of Bronx prosecutors took over the main evidence room in the NYPD ticket-fixing scandal — drinking and partying among the piles of tapes and files before a Yankee game, The Post has learned. About 40 people, including prosecutors and their civilian guests, milled around room 617 during the boozy May 23 bash at the Bronx District Attorney’s Office, where, sources said, Internal Affairs probers keep the mountain of wiretaps and documents for DA Robert Johnson’s sweeping ticket-fixing case against 16 NYPD cops and five civilians. “It could damage the whole ticket-fixing case,” a source who witnessed the revelry told The Post. “If even one civilian got through the door, it’s a problem. Evidence must be safeguarded in a secure location.” The door to room 617 is usually locked and bears a sign that reads: “No Unauthorized Entry.” It’s unclear whether someone in IAB granted the city lawyers access or whether someone in the DA’s Office had the key. During its ticket-fixing probe, IAB secretly recorded a staggering 139,000 phone calls and intercepted 311,000 text messages and e-mails. The judge in the case has said there are also an estimated 20,000 pages of grand-jury minutes and testimony. “Evidence is everywhere in there, stacked in boxes, floor to ceiling,” one source said of room 617. “It’s the field office for Bronx IAB.” “The reason this is a problem is that the room is supposed to be locked 24/7.” “This will raise questions. This is no way to run an investigation. The Bronx DA will have to admit it happened . . . There were too many people, too many witnesses [not to].” The Wednesday night party — a warm-up for that evening’s Bronx DA Night at Yankee Stadium — started at the Bronx’s DA’s sixth floor reception area, which had been set up as a bar, sources said. But prosecutors, their girlfriends and other guests were soon milling in and out of room 617, a witness said. “They were all right there, next to the evidence,” the witness said. A spokesman for DA Johnson confirmed the pre-game festivities but insisted the party didn’t compromise evidence. “Present and former staff members and their families gathered at the office prior to attending a Yankees game,” said DA spokesman Steve Reed. “They conducted themselves maturely and did nothing to compromise the work of the office.” One source scoffed at the notion that “families” were included in the boozy blowout and said there were no kids in sight. “If your family includes a stable of hot women, then I guess you could call it a ‘family’ event,” the source said. With the drinks free-flowing, several partygoers even bailed on the Yankee game. “Most never made it to the game. It’s always that good of a party,” one source said. It’s unclear whether IAB investigators or detectives and rank-and-file NYPD cops attended the festivities. But one law-enforcement source heard cops discussing the party ahead of time. “I heard people joking that this party was going on, and that we should go after them,” the source said. jeane.macintosh@nypost.com

The New York Post by Kirstan Conley and Jeane MacIntosh - June 4, 2012

A rowdy group of Bronx prosecutors took over the main evidence room in the NYPD ticket-fixing scandal — drinking and partying among the piles of tapes and files before a Yankee game, The Post has learned. About 40 people, including prosecutors and their civilian guests, milled around room 617 during the boozy May 23 bash at the Bronx District Attorney’s Office, where, sources said, Internal Affairs probers keep the mountain of wiretaps and documents for DA Robert Johnson’s sweeping ticket-fixing case against 16 NYPD cops and five civilians. “It could damage the whole ticket-fixing case,” a source who witnessed the revelry told The Post. “If even one civilian got through the door, it’s a problem. Evidence must be safeguarded in a secure location.” The door to room 617 is usually locked and bears a sign that reads: “No Unauthorized Entry.” It’s unclear whether someone in IAB granted the city lawyers access or whether someone in the DA’s Office had the key. During its ticket-fixing probe, IAB secretly recorded a staggering 139,000 phone calls and intercepted 311,000 text messages and e-mails. The judge in the case has said there are also an estimated 20,000 pages of grand-jury minutes and testimony. “Evidence is everywhere in there, stacked in boxes, floor to ceiling,” one source said of room 617. “It’s the field office for Bronx IAB.” “The reason this is a problem is that the room is supposed to be locked 24/7.” “This will raise questions. This is no way to run an investigation. The Bronx DA will have to admit it happened . . . There were too many people, too many witnesses [not to].” The Wednesday night party — a warm-up for that evening’s Bronx DA Night at Yankee Stadium — started at the Bronx’s DA’s sixth floor reception area, which had been set up as a bar, sources said. But prosecutors, their girlfriends and other guests were soon milling in and out of room 617, a witness said. “They were all right there, next to the evidence,” the witness said. A spokesman for DA Johnson confirmed the pre-game festivities but insisted the party didn’t compromise evidence. “Present and former staff members and their families gathered at the office prior to attending a Yankees game,” said DA spokesman Steve Reed. “They conducted themselves maturely and did nothing to compromise the work of the office.” One source scoffed at the notion that “families” were included in the boozy blowout and said there were no kids in sight. “If your family includes a stable of hot women, then I guess you could call it a ‘family’ event,” the source said. With the drinks free-flowing, several partygoers even bailed on the Yankee game. “Most never made it to the game. It’s always that good of a party,” one source said. It’s unclear whether IAB investigators or detectives and rank-and-file NYPD cops attended the festivities. But one law-enforcement source heard cops discussing the party ahead of time. “I heard people joking that this party was going on, and that we should go after them,” the source said. jeane.macintosh@nypost.com

Saturday, June 2, 2012

Judges From High-Profile Drug Cases Suspended

Mexico suspends, probes judges of key drug cases

The Associated Press by Adriana Gomez Licon - June 2, 2012

MEXICO CITY (AP) — Mexican court authorities have suspended two federal judges who presided over high-profile drug cases, saying investigators are looking into possible irregularities involving the jurists. The Federal Judiciary Council said Friday evening that it was temporarily relieving appellate Judge Jesus Guadalupe Luna and district Judge Efrain Cazares of their duties, but its statement didn't describe the allegations being investigated. The Attorney General's Office declined to comment Saturday. Both judges have taken part in cases involving well-known people with alleged ties to Mexico's drug business. In April 2008, Luna ordered the release of the son of purported Sinaloa drug cartel chief Joaquin "El Chapo" Guzman. Ivan Archivaldo Guzman Salazar had been sentenced by a lower court to five years in prison for money laundering, but the appellate judge ruled that there was no proof the money he used to open two bank accounts came from drug trafficking and that being the son of the infamous capo wasn't grounds for imprisonment. Last summer, Luna upheld a lower court ruling that cleared Sandra Avila Beltran of organized-crime charges despite efforts by Mexico and the U.S. to prosecute the woman nicknamed "Queen of the Pacific." Avila is wanted on a 2004 U.S. indictment as a suspect tied to the seizure of more than nine tons of U.S.-bound cocaine on Mexico's west coast. A judge acquitted Avila in December 2010 of charges stemming from that drug confiscation, and Luna backed that decision by citing a lack of evidence. U.S. authorities have sought extradition of Avila, a niece of Miguel Angel Felix Gallardo, known as "the godfather" of Mexican drug smuggling, but that has been rejected twice by other judges on grounds she shouldn't be prosecuted in the U.S. on charges that have been dismissed in Mexico. The other suspended judge, Cazares, has been accused by Mexico's government of ignoring credible evidence when he released some of the mayors detained in a mass arrest of officials in the western state of Michoacan in 2009. The federal attorney general alleged the officials had ties to the La Familia drug gang, and prosecutors filed a complaint against Cazares saying he improperly acquitted the officials. With all of the officials freed by various judges, the crackdown became one of the most embarrassing episodes in President Felipe Calderon's 5 1/2-year-long offensive against drug cartels. Most recently, drug battles have escalated as Mexico's two most powerful drug cartels, the Sinaloa and Zetas gangs, wage a war in several regions considered strongholds of one or the other. Late Friday, a group of armed men opened fire on a police station in the border city of Matamoros, which is across the Rio Grande from Brownsville, Texas. Tamaulipas state Interior Secretary Morelos Canseco Gomez said they threw an explosive, possibly a grenade, but no one was injured in the attack. Canseco said he did not know the motive or the gang behind it. The attack came only days after suspected drug cartel gunmen set off a car bomb near a police barracks in the same state, wounding eight officers. Adriana Gomez Licon on Twitter: http://twitter.com/agomezlicon

The Associated Press by Adriana Gomez Licon - June 2, 2012

MEXICO CITY (AP) — Mexican court authorities have suspended two federal judges who presided over high-profile drug cases, saying investigators are looking into possible irregularities involving the jurists. The Federal Judiciary Council said Friday evening that it was temporarily relieving appellate Judge Jesus Guadalupe Luna and district Judge Efrain Cazares of their duties, but its statement didn't describe the allegations being investigated. The Attorney General's Office declined to comment Saturday. Both judges have taken part in cases involving well-known people with alleged ties to Mexico's drug business. In April 2008, Luna ordered the release of the son of purported Sinaloa drug cartel chief Joaquin "El Chapo" Guzman. Ivan Archivaldo Guzman Salazar had been sentenced by a lower court to five years in prison for money laundering, but the appellate judge ruled that there was no proof the money he used to open two bank accounts came from drug trafficking and that being the son of the infamous capo wasn't grounds for imprisonment. Last summer, Luna upheld a lower court ruling that cleared Sandra Avila Beltran of organized-crime charges despite efforts by Mexico and the U.S. to prosecute the woman nicknamed "Queen of the Pacific." Avila is wanted on a 2004 U.S. indictment as a suspect tied to the seizure of more than nine tons of U.S.-bound cocaine on Mexico's west coast. A judge acquitted Avila in December 2010 of charges stemming from that drug confiscation, and Luna backed that decision by citing a lack of evidence. U.S. authorities have sought extradition of Avila, a niece of Miguel Angel Felix Gallardo, known as "the godfather" of Mexican drug smuggling, but that has been rejected twice by other judges on grounds she shouldn't be prosecuted in the U.S. on charges that have been dismissed in Mexico. The other suspended judge, Cazares, has been accused by Mexico's government of ignoring credible evidence when he released some of the mayors detained in a mass arrest of officials in the western state of Michoacan in 2009. The federal attorney general alleged the officials had ties to the La Familia drug gang, and prosecutors filed a complaint against Cazares saying he improperly acquitted the officials. With all of the officials freed by various judges, the crackdown became one of the most embarrassing episodes in President Felipe Calderon's 5 1/2-year-long offensive against drug cartels. Most recently, drug battles have escalated as Mexico's two most powerful drug cartels, the Sinaloa and Zetas gangs, wage a war in several regions considered strongholds of one or the other. Late Friday, a group of armed men opened fire on a police station in the border city of Matamoros, which is across the Rio Grande from Brownsville, Texas. Tamaulipas state Interior Secretary Morelos Canseco Gomez said they threw an explosive, possibly a grenade, but no one was injured in the attack. Canseco said he did not know the motive or the gang behind it. The attack came only days after suspected drug cartel gunmen set off a car bomb near a police barracks in the same state, wounding eight officers. Adriana Gomez Licon on Twitter: http://twitter.com/agomezlicon

Friday, June 1, 2012

Judges Should Write Their Own Opinions

Judges Should Write Their Own Opinions

The New York Times by William Domnarski - OP-ED Contributor - May 31, 2012

Riverside, Calif. - There is a crisis in the federal appellate judiciary. No, I’m not referring to the high number of judicial vacancies or overloaded case dockets — though those are real problems. The crisis I have in mind rarely is discussed because it raises too many embarrassing questions. I’m talking about the longstanding and well-established practice of having law clerks ghostwrite judges’ legal opinions. We have become too comfortable with the troubling idea that judging does not require that judges do their own work. With so much news and controversy about what federal appellate judges say in their opinions, it would be natural for a layperson to assume that such opinions actually come from judges’ own pens (or keyboards). But ever since the beginning of the law-clerk age, which dates back at least 70 years, most judges have been content to cast their vote in a case and then merely outline the shape of their argument — while leaving it to their clerks to do the hard work of shaping the language, researching the relevant precedents and so on. Almost all federal appellate judges today follow this procedure. There are, of course, understandable reasons for this arrangement. For one thing, it’s efficient: it helps judges manage the ever increasing flow of cases to be decided. It’s also familiar: it resembles the modern law-firm model (known to many judges from earlier stages in their careers) in which associates draft documents and senior partners edit them. Furthermore, the law is not a literary pursuit but a system of rules, principles and arguments: in a legal opinion the fine points of language can seem less important than the underlying logic of the decision. But in truth, much of importance is lost when judges outsource the writing of their opinions to their less experienced assistants. Judge-written opinions require greater intellectual rigor, exhibit more personal style and lend themselves to more honest and transparent conclusions.

An informal review of federal appellate court opinions over the past five years suggests that of the more than 150 active judges, only a tiny number almost always write their own opinions in full, among them Frank H. Easterbrook, Richard A. Posner and Diane P. Wood, of the United States Court of Appeals for the Seventh Circuit, and Michael Boudin, of the First Circuit. A few others evidently write a fair percentage of their opinions from start to finish. Another relatively small group adds stylistic flair like dramatic introductions or figurative language. The former appellate judge Abner J. Mikva has said that when he served on the District of Columbia Circuit, he reserved for himself the opening paragraph of his opinions. It is no coincidence that Judge Posner, the most influential (and most widely cited) appellate judge of his generation, writes his own opinions. His judicial voice is marked with stylistic touches, to be sure, shunning (and even lampooning) legalese as well as disregarding the traditional five-part structure on which law clerks typically rely. But what most grabs the reader is the voice of a judge thoroughly engaged with a problem in the law and working through it with enthusiasm, almost joy. As Judge Posner himself has written, “I know that only a few of the readers of my opinions are not lawyers, but the exercise of trying to write judicial opinions in a way that makes them accessible to intelligent lay persons contributes to keeping the law in tune with human and social needs and understandings and avoiding the legal professional’s natural tendency to mandarin obscurity and preciosity.” Unlike lawyers who are paid to argue for just one side in a case, judges are paid to pursue the truth. The bench is free from the limitations of advocacy; judges get to test arguments and follow a line of reasoning wherever it might take them. They get to explore the law. The opinion, properly done, reveals the judge sorting through the problem, thinking on the page. For similar reasons, judge-written opinions are also less vulnerable to a judge’s reflexive political and ideological leanings. The act of writing brings judges closer to the specific details and relevant issues of a case, forcing them to reckon with the case at hand in all its particulars, rather than seeing it as an instance of some more general theory or problem. There is also the matter of intellectual integrity. Put simply, it cannot be accepted as legitimate that judges can put their names on opinions that they did not write. It’s not quite plagiarism, but it puts me in mind of the product known in the academic world as “managed books”: a professor will use research assistants to not only research a project but also write a first draft — but nonetheless the professor claims the work as his own. The managed books approach has been condemned as an affront to intellectual integrity. There is no principled reason the judicial counterpart should not be similarly condemned. I am reminded of Henry J. Friendly, the great judge of the Second Circuit, who explained that he wrote his own opinions because “they pay me to do that.” Younger members of the judiciary need to take a hard look at themselves and ask how what they are doing stacks up against the known examples of judging at its highest level — not just Judge Posner and his contemporaries who write, but also gifted writers among judges of earlier eras like Learned Hand and Oliver Wendell Holmes Jr. The next generation will need to accept the opportunities and challenges of appellate judging and dare to do all the work that befits a judge. William Domnarski, a lawyer, is the author of “Federal Judges Revealed.”

The New York Times by William Domnarski - OP-ED Contributor - May 31, 2012