The New York Law Journal by Mark Hamblett - January 4, 2011

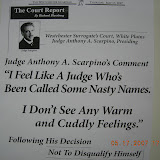

Consumers charging a law firm and two other entities with a scheme to fraudulently obtain more than 100,000 default judgments in state court have prevailed in their bid to overcome a motion to dismiss in federal court. Second Circuit Judge Denny Chin, a former Southern District judge sitting by designation, refused to dismiss claims alleging the use of "sewer service," a process involving the intentional failure to serve a summons and complaint followed by the filing of a phony affidavit attesting to service. The debtor, who has no knowledge of the process, fails to appear and defaults. The term "sewer service" is named after the practice of throwing the summons and complaint into the sewer outside of a defendant's home and claiming to have effectuated service. Plaintiffs charged the "massive scheme" was perpetrated by a debt-buying company, Leucadia National Corp.; law firm Mel S. Harris and Associates of 5 Hanover Square, which engaged in debt-collection litigation on behalf of Leucadia and its subsidiaries; and Samserv Inc., a Brooklyn-based process serving agency. In Sykes v. Mel Harris and Associates, 09 Civ. 8486, consumers allege violations of the Fair Debt Collection Practices Act, 15 U.S.C. §1692, the Racketeer Influenced and Corrupt Practices Act, 18 U.S.C. §1961, New York General Business Law §349, and New York Judiciary Law §487. The plaintiffs claim that the Harris law firm and Leucadia joined to purchase debt portfolios and begin debt collection en masse, filing 104,341 debt collection actions in New York City Civil Court between 2006 and 2008, and hiring Samserv to serve process. In all, the plaintiffs allege, more than 90 percent of the targets defaulted because they were not actually served. Once a consumer fails to appear, Leucadia and Mel Harris provide proof of service, proof of additional mailed notice and an "affidavit of merit" swearing to their personal knowledge of facts substantiating their claims. "Leucadia had limited proof to substantiate its claims because it typically did not purchase documentation of the consumers' indebtedness to the original creditors," Judge Chin said. "Nonetheless, the Mel Harris defendants' 'designated custodian of records,' Todd Fabacher, signed the vast majority of the approximately 40,000 affidavits of merit they filed each year." Mr. Fabacher had to aver to personal knowledge that the debt was due and owing, Judge Chin said, and that means he would have had to issue 20 affidavits per hour or "one every three minutes," during the course of an eight-hour work day. Judge Chin said that two of the eight named plaintiffs had statute of limitations problems, but the statute in their case was "equitably tolled" because the "defendants deprived them of notice of their debt collection actions." The Mel Harris defendants, which included the law firm, its principals and affiliated individuals, had argued that the Fair Debt Collection Practices Act does not prohibit the filing of debt collection actions and affidavits of merit.

False Affidavits Claimed

But Judge Chin said the plaintiffs alleged far more than simply the claim that the law firm defendants lacked "physical evidence of the debt." They also allege, he said, "that they knowingly authorized defendant Fabacher to file false affidavits of merit—misleading both the Civil Court and consumer-defendants—to secure default judgments that enabled them to freeze bank accounts, threaten to garnish wages, or pressure individuals into settlements." Judge Chin dismissed racketeering claims against five individual process servers, Mel Harris manager David Waldman and two officers of Leucadia or its subsidiaries. He also rejected the plaintiffs' claim that there were three distinct racketeering enterprises. Nonetheless, Judge Chin found that the complaint properly alleged a single racketeering enterprise. The defendants had argued that the plaintiffs' pleadings fell short on the racketeering conspiracy claim, and moved for dismissal. But Judge Chin said "the pleadings sufficiently allege substantive RICO violations and plausibly establish an agreement among the defendants." He denied the Samserv defendants' motion to dismiss racketeering conspiracy claims with respect to all Samserv defendants, including five individual process servers, and all other defendants. The lone exception here was his dismissal of racketeering conspiracy claims against Mr. Waldman and the two Leucadia officers.

Judiciary Law Claim

Judge Chin then ruled that, under General Business Law §349, which governs deceptive acts or practices, the plaintiffs' claims were not moot even though the default judgments have been vacated by state courts or by agreement with the defendants. Finally, he refused to dismiss the claim against the Mel Harris defendants under Judiciary Law §487, under which an attorney can be charged with a misdemeanor and be liable for damages when he engages in "any deceit, or collusion, or consents to any deceit or collusion, with intent to deceive the court or any party." A status conference is scheduled for Jan. 11. The plaintiffs are represented by Matthew D. Brinckerhoff and Elisha Jain of Emery Celli Brinckerhoff & Abady; Susan Shin, Claudia Wilner and Josh Zinner of the Neighborhood Economic Development Advocacy Project; and Carolyn E. Coffey, Andrew Goldberg and Anamaria Segura of MFY Legal Services Inc. The Mel Harris defendants are represented by Brett A. Scher of Kaufman Dolowich Voluck & Gonzo. The Leucadia defendants are represented by Lewis Goldfarb of McElroy, Deutsch, Mulvaney & Carpenter. The Samserv defendants are represented by Jordan Sklar of Babchik & Young.

False Affidavits Claimed

But Judge Chin said the plaintiffs alleged far more than simply the claim that the law firm defendants lacked "physical evidence of the debt." They also allege, he said, "that they knowingly authorized defendant Fabacher to file false affidavits of merit—misleading both the Civil Court and consumer-defendants—to secure default judgments that enabled them to freeze bank accounts, threaten to garnish wages, or pressure individuals into settlements." Judge Chin dismissed racketeering claims against five individual process servers, Mel Harris manager David Waldman and two officers of Leucadia or its subsidiaries. He also rejected the plaintiffs' claim that there were three distinct racketeering enterprises. Nonetheless, Judge Chin found that the complaint properly alleged a single racketeering enterprise. The defendants had argued that the plaintiffs' pleadings fell short on the racketeering conspiracy claim, and moved for dismissal. But Judge Chin said "the pleadings sufficiently allege substantive RICO violations and plausibly establish an agreement among the defendants." He denied the Samserv defendants' motion to dismiss racketeering conspiracy claims with respect to all Samserv defendants, including five individual process servers, and all other defendants. The lone exception here was his dismissal of racketeering conspiracy claims against Mr. Waldman and the two Leucadia officers.

Judiciary Law Claim

Judge Chin then ruled that, under General Business Law §349, which governs deceptive acts or practices, the plaintiffs' claims were not moot even though the default judgments have been vacated by state courts or by agreement with the defendants. Finally, he refused to dismiss the claim against the Mel Harris defendants under Judiciary Law §487, under which an attorney can be charged with a misdemeanor and be liable for damages when he engages in "any deceit, or collusion, or consents to any deceit or collusion, with intent to deceive the court or any party." A status conference is scheduled for Jan. 11. The plaintiffs are represented by Matthew D. Brinckerhoff and Elisha Jain of Emery Celli Brinckerhoff & Abady; Susan Shin, Claudia Wilner and Josh Zinner of the Neighborhood Economic Development Advocacy Project; and Carolyn E. Coffey, Andrew Goldberg and Anamaria Segura of MFY Legal Services Inc. The Mel Harris defendants are represented by Brett A. Scher of Kaufman Dolowich Voluck & Gonzo. The Leucadia defendants are represented by Lewis Goldfarb of McElroy, Deutsch, Mulvaney & Carpenter. The Samserv defendants are represented by Jordan Sklar of Babchik & Young.

17 comments:

Corrupt Practices in the New York court system will no longer be 'business as usual'

.....dare to dream.....

Why are these lawyers still practicing?

I was a victim of "sewer service" by the Law Offices of Mel S. Harris...they were representing LR CREDIT 20 LLC...I filed an answer to their bogus S & C...appeared in Court to fight this..subsequently, the Judge dismissed the complaint..on the outside of Court's envelope it read, "BS AFF"...Their process server..Steven Cardi from(Acu-Serve)submitted false affidavits of service to the Court...I presently have a grievance complaint pending against Mel S. Harris at the First Departmental Disciplinary Committee..61 Broadway, New York, NY..(Docket No:2010. 2887).

to much.

Proper Service, Proper Pleadings, Proper review and entitlement the Default Judgment itself..

+ to

;)

I would like to know..

How do they freeze bank accts and take assets without some "Execution"??

This can't be proper...

While we're at it, How is it that the Federal Government is so quick to investigate the "snow" job that sanitation workers did during a 24 hour snow storm, but have continually and repeatedly ignored the more serious wrongdoing by the attorneys, courts and judicial administration in New York?

Anyone how someone got them to suddenly do anything about corruption in NY?

This sewer service and illegal judgments against debtors, which has been known for years, is done in the 9th Judicial District under Administrative Justice Alan Scheinkman all the time. There probably isn't one case where there was actually a lawful judgment obtained under his watch.

Justice Scheinkman runs the 9th Distinct under the Nero model of management.

Did Judge Chin have an epiphany (a spiritual revelation)of the place in Hell where NY judges go? Judgment day will come for them all.

Saint Mario Cumo got a nice press release that claimed he was going to through out I think it was 100,000 of those junk lawsuits filled by several of theses law firms. NONE WERE THROWN out they were modified. The lawyers tok money out of peoples bank accounts that were never served.

Then because they were not served the law firms that were representing them gave them some of the money. The law firms were charging interest and penaltys that you could have gotten better rates from Loansharks.

IKn some cases that the lawyers had gotten judgments on people that were not served they took a little money of the account but the case was never thrown out. CUMO protected the law firms. The cases should have been thrown out and the holders of the debt (debt collection) companys would have sued the lawyers to get back thier money. To protect the lawyers from being sued he did not throw out the cases. They were defective and should have been vacated. ALL THOSE

suits that were served by those companys should have been vacated

OK so one good decision but what about the Fed Govt and Fed Courts in the related cases, cases in general in fed courts in ny where clear corruption / actionable Constitutional violations and more go on? What about NY getting "rocked" by the Feds out of DC? Hope it happens, needs to happen, and way overdue but often looks like Feds are part of the problem at least in NY as allow things to go on so long with no redress, remedy, change or anything. But always looking for light at the end of the tunnel and hope.

hvr

I was never served, there was no proof of service but that didn't matter to Judge Barone, he didn't care since the fix was in. And when I told my own attorney about it he said it was too late, he screwed me too. No wonder I have no use for attorneys, Judges or the courts.

I've got one that no one can top.

I was never served.

There was never any court proceeding.

Yet, the attorney seems to have obtained a judgement against me for almost $10,000.

The only way I found out about this was going to the county clerk's website to check on another case I have been in court for for several years.

I saw the judgment against me and then went to the Court's website to see when it was tried only to find that there is absolutely no record of the case being in any court in the County ever. Not under my name, the plaintiff's name or the docket number that was supposedly issued.

This is how Scheinkman runs his courts. This is the second time that there was allegedly a court proceeding but nothing was ever on any court calendar.

All court proceedings are public and how is anyone supposed to be able to attend a court proceeding if it is never calendared?

So, not only was I never served, but the case was never put on a court calendar. Yet somehow there was a judgment entered against me in the county.

Way to go Scheinkman. This is how you run your Courts?

This is the tip of the corruption iceberg and a blind eye has been the attitude by legal system, including Judges since a big slice of them engaged in this business.

My boss just received a letter to garnish my wages. Almost 5 years ago I had my bank account frozen due to this I was not living in NY prior to this so never received any notice. Secondly I have no idea what the debt was and they could not give me any details. A complete scam. Why is he not in jail for this ?

Well, and no surprise, this crap is going on in Oklahoma too. I'm sure this is not the only state, the court system and the attorney's in this country are so damn corrupt, it's time the citizens' Demand oversight over them or shut them down!

http://rocklandgov.com/departments/consumer-protection-weights-and-measures/

Post a Comment